Lyft car accident settlement: Maximize 2025

Understanding Lyft Car Accident Settlements: What You Need to Know

A lyft car accident settlement is compensation for injuries from an accident with a Lyft vehicle, covering medical bills, lost income, and pain and suffering. These cases are more complex than typical car accidents because of multiple, shifting insurance policies.

Quick Settlement Overview:

- Minor injuries: $10,000 – $50,000 (bruises, mild whiplash)

- Moderate injuries: $50,000 – $200,000 (fractures, concussions)

- Severe injuries: $200,000 – $1,000,000+ (brain injury, spinal damage)

- Timeline: 3-6 months for simple cases, 1+ years for complex cases

- Key factor: Lyft’s insurance coverage varies by driver app status

Rideshare accidents involve multiple layers of insurance coverage that change based on the driver’s app status. When the app is off, the driver’s personal insurance applies. But when a ride is in progress, Lyft provides up to $1 million in liability coverage. This creates unique challenges for victims.

Understanding these insurance layers is crucial, as the wrong approach can cost you thousands. Insurance companies often use this complexity to minimize payouts.

As a board-certified civil trial lawyer who has handled over 40,000 injury cases in Florida, I’ve seen that rideshare accidents require specialized knowledge to steer the lyft car accident settlement process. My experience shows that understanding these unique insurance structures is essential for securing fair compensation.

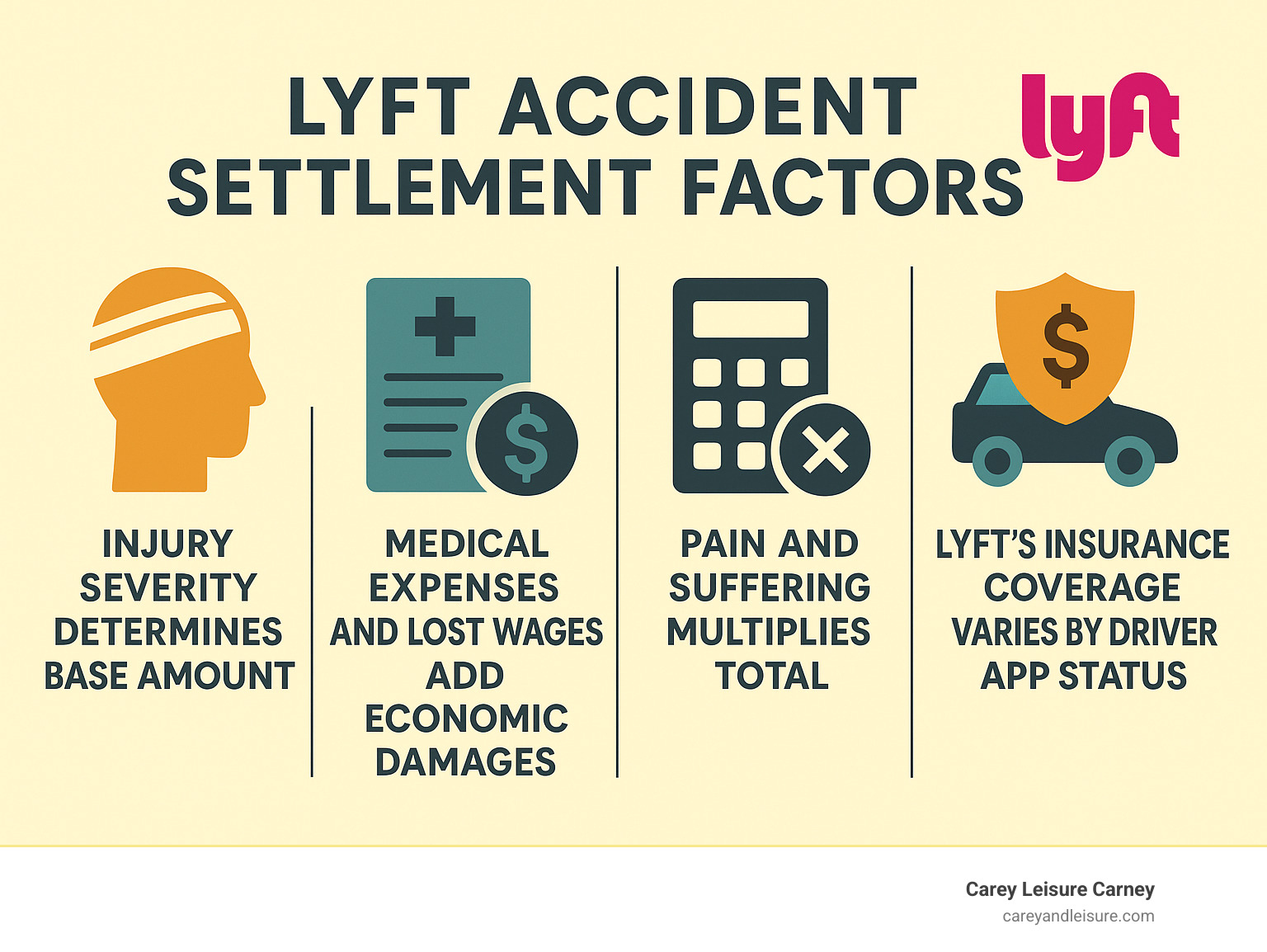

Key Factors That Determine Your Settlement Amount

Every lyft car accident settlement is unique, but the amount you receive depends on a mix of factors. The most significant are the severity of your injuries, your medical bills, lost income, and who was at fault for the crash. Several factors play a significant role in these calculations. While many settlements range from $15,000 to $350,000, catastrophic injuries can lead to awards of over a million dollars.

Severity of Injuries and Medical Expenses

More serious injuries typically mean higher settlements because of the significant costs and life changes involved.

- Minor injuries like bruises or mild whiplash often result in settlements between $10,000 and $50,000 to cover medical bills and some missed work.

- Moderate injuries such as broken bones or concussions require more extensive treatment, with settlements typically falling between $50,000 and $200,000.

- Severe injuries like traumatic brain injuries or spinal cord damage can change your life forever. Car accidents and traumatic brain injuries can lead to settlements from $200,000 to over $1 million to cover lifelong care and rehabilitation.

Your medical expenses, both past and future, form the foundation of your economic damages. This includes ambulance rides, hospital stays, physical therapy, and any necessary home modifications or specialized equipment.

Lost Wages and Future Earning Capacity

A fair lyft car accident settlement must cover all income lost due to your injuries.

Documenting your lost income involves collecting pay stubs, employment records, and letters from your employer. For the self-employed, tax returns and business records are essential.

If your injuries prevent you from returning to your previous job or limit your career advancement, you may be compensated for lost future earning capacity. This often requires a vocational expert to assess the long-term financial impact of your injuries.

Pain, Suffering, and Other Non-Economic Damages

Compensation is also available for non-economic damages like emotional distress, mental anguish, and the loss of enjoyment of life. These damages cover the physical pain and emotional trauma from the accident, such as developing anxiety or being unable to enjoy hobbies.

Insurance companies often use a “multiplier method” (multiplying economic damages by 1.5 to 5) or a “per diem method” (a daily rate for pain) to calculate these damages. These calculations are a crucial part of receiving fair compensation for pain and suffering in Florida: What you need to know.

Determining Liability Under Florida’s Fault Laws

Proving who caused the accident is a critical factor in your lyft car accident settlement. To establish liability, you must prove the other party was negligent—that they had a duty to drive safely, breached that duty, and caused your injuries. Evidence like police reports, witness statements, and traffic camera footage is vital.

Florida uses a “modified comparative negligence rule.” This means you can still recover damages if you were partially at fault, but your award will be reduced by your percentage of fault.

However, if you are found to be 51% or more at fault, you cannot recover any damages. This “51% fault bar” makes it essential to build a strong case proving the other party was primarily responsible. For example, a $100,000 award would be reduced to $80,000 if you were 20% at fault, but you would receive nothing if you were 51% at fault.

Navigating Lyft’s Complex Insurance Policies

A Lyft accident involves navigating multiple layers of insurance coverage that change depending on the driver’s status at the time of the crash. Because drivers are independent contractors, their insurance shifts based on whether they are offline, waiting for a ride, or actively transporting a passenger.

For victims seeking a lyft car accident settlement, this creates both opportunities and challenges. Identifying the correct insurance policy is critical; a mistake could mean dealing with a driver’s minimal personal coverage instead of Lyft’s million-dollar policy. Understanding these insurance layers is essential for protecting your rights.

The Three “Periods” of Lyft Insurance Coverage

Lyft’s insurance is divided into three periods, each with different coverage levels. Knowing which period applies to your accident determines the available compensation for your lyft car accident settlement.

- Period 0: App Off: The driver is not working, and their app is closed. Only the driver’s personal auto insurance applies, which may have low limits (e.g., Florida’s $10,000 minimums).

- Period 1: App On, Waiting for a Request: The driver is logged in and available. Lyft provides contingent liability coverage that applies if the driver’s personal policy denies the claim. This includes up to $50,000 per person for bodily injury ($100,000 per accident) and $25,000 for property damage.

- Period 2 & 3: En Route and During the Ride: From the moment a driver accepts a request until the ride ends, Lyft provides at least $1 million in liability coverage. This policy covers injuries to passengers, other drivers, and pedestrians, as well as property damage if the Lyft driver is at fault.

Understanding the applicable period is crucial. You can learn more about Lyft’s insurance coverage for drivers on their website. Additionally, Uninsured/Underinsured Motorist (UM/UIM) coverage from Lyft or your own policy can provide protection if an at-fault driver is uninsured or underinsured.

Dealing with Insurance Companies and Their Tactics

Insurance adjusters are trained negotiators whose job is to settle claims for the lowest possible amount. Their loyalty is to their employer’s bottom line, not your recovery. Common tactics include:

- Requesting recorded statements: Anything you say can be used against you to reduce your settlement. It’s best to decline until you’ve spoken with an attorney.

- Making lowball settlement offers: The first offer is almost never fair. It’s a tactic to see if you’ll accept less than you deserve out of pressure.

- Using delaying tactics: By dragging out the process, insurers hope you’ll become desperate and accept a lower offer.

- Disputing injury severity: They may claim your injuries are pre-existing or not as serious as you state, highlighting the need for thorough medical documentation.

An experienced Personal Injury Attorney understands these tactics and can counter them effectively. We know how to value your claim, gather evidence, and negotiate from a position of strength, often leading to more reasonable offers. With the right guidance, you can focus on healing while we handle the complexities of securing your lyft car accident settlement.

Steps to Take to Maximize Your Lyft Car Accident Settlement

Securing a fair lyft car accident settlement requires taking deliberate steps from the moment the crash occurs. Your actions in the first hours and days after a Lyft accident can significantly impact your case. While Florida’s statute of limitations gives you two years to file a lawsuit, evidence can disappear and memories can fade quickly. It’s crucial to start building your case immediately.

Immediately After the Accident

After a crash, focus on these critical steps to protect your health and your claim for a lyft car accident settlement.

- Call 911: A police report is an official record of the accident that insurance companies take seriously. Without it, your claim becomes a “he said, she said” dispute.

- Seek medical attention: Adrenaline can mask serious injuries. In Florida, you must seek medical treatment within 14 days to qualify for Personal Injury Protection (PIP) benefits.

- Do not admit fault: Avoid saying “I’m sorry” or making any statements that could be interpreted as an admission of guilt. Stick to the facts.

- Exchange information: Get names, phone numbers, insurance details, and vehicle information from all drivers and witnesses. For a complete guide, see our advice on What to do after a car accident Florida.

Gathering Crucial Evidence for Your Claim

The more evidence you collect, the stronger your lyft car accident settlement case will be.

- Take photos and videos: Document vehicle damage, the accident scene, road conditions, traffic signs, skid marks, and your visible injuries from multiple angles.

- Get witness contact information: Obtain names and phone numbers on the spot. An unbiased witness account is invaluable.

- Document the Lyft ride: If you were a passenger, save your ride receipt and trip details from the app. This proves you were a customer under Lyft’s $1 million policy.

- Keep meticulous records: Save all medical bills, prescriptions, and therapy records to prove your injuries.

- Obtain the police report: This report contains the officer’s initial assessment of fault and key witness statements.

Filing a Claim and Initiating Your Lyft Car Accident Settlement Process

Once you’ve gathered evidence, it’s time to formally pursue your lyft car accident settlement.

Report the accident directly to Lyft through their official portal. You can Complete an accident report to submit your claim.

An attorney can help notify all relevant insurance companies, including Lyft’s, the driver’s, your own, and any other at-fault parties.

Next, a demand letter is prepared. This comprehensive document outlines the facts of the case, details your injuries and damages, and makes a clear argument for the compensation you deserve.

The negotiation process follows, which involves back-and-forth discussions with the insurance company. Experience is critical here, as insurers use various tactics to reduce payouts. Patience during this phase can lead to a significantly higher settlement.

Frequently Asked Questions about Lyft Settlements

Dealing with a lyft car accident settlement can be overwhelming. Here are answers to the most common questions we receive from clients.

How long does a Lyft accident settlement take?

The timeline depends on the complexity of your case.

- Simple cases with clear liability and minor injuries can often resolve in three to six months.

- Complex cases involving severe injuries, liability disputes, or uncooperative insurers can take a year or more, especially if litigation is necessary.

Factors like liability disputes and the need to wait for maximum medical improvement can extend the timeline. While waiting is frustrating, settling too early can cost you significant compensation.

What is the average lyft car accident settlement?

There is no true “average” settlement, as each lyft car accident settlement is unique to the victim’s injuries and losses. However, we can provide general ranges based on injury severity:

- Minor injuries (bruises, mild whiplash): $10,000 to $50,000

- Moderate injuries (fractures, concussions): $50,000 to $200,000

- Severe injuries (spinal damage, TBI): $200,000 to over $1 million

High-value settlements are possible due to Lyft’s $1 million liability policy, which applies when a driver is actively transporting a passenger. This coverage can compensate for catastrophic injuries, extensive medical care, and lost earning capacity. Properly documenting damages is key to understanding How to get the most compensation from a car accident settlement in Florida.

Can I still get a settlement if the at-fault driver is uninsured?

Yes. If the at-fault driver is uninsured or underinsured, you have several paths to compensation for your lyft car accident settlement.

- Lyft’s UM/UIM coverage: Lyft carries Uninsured/Underinsured Motorist (UM/UIM) coverage for drivers and passengers, which can be up to $1 million when a ride is in progress.

- Your personal auto policy: Your own UM/UIM coverage applies even when you are a passenger in another vehicle. Stacked coverage on multiple vehicles can further increase your available compensation.

- Personal Injury Protection (PIP): Your own PIP coverage provides immediate benefits, covering 80% of medical bills and 60% of lost wages up to $10,000, regardless of fault. This provides financial relief while your larger claim is pursued. Learn more about What is covered under Personal Injury Protection.

The layered insurance system in rideshare accidents provides multiple potential sources of recovery.

Secure the Compensation You Deserve

After a Lyft accident, you should be focused on recovery, not battling complex insurance policies and aggressive adjusters on your own. Navigating a lyft car accident settlement without experienced legal help can be a costly mistake.

The challenges discussed in this guide, from Lyft’s three-tiered insurance system to Florida’s comparative negligence laws, are real obstacles that insurers use to minimize payouts. They have teams of lawyers working against you; you deserve the same level of professional advocacy fighting for your rights.

At Carey Leisure Carney, we have over 100 years of combined experience helping Florida families secure the compensation they deserve. Our Board-Certified attorneys represent the top 2% of lawyers in Florida, a distinction reflecting our commitment to excellence and results.

We believe in direct attorney access and personalized service. You work directly with experienced attorneys who understand the unique challenges of rideshare accident cases, not case managers. We know every lyft car accident settlement is different and requires individual attention to your medical bills, lost wages, and pain and suffering.

Whether you’re in Clearwater, Largo, New Port Richey, Spring Hill, St Petersburg, Trinity, Wesley Chapel, or anywhere else in Florida, we’re here to protect your rights and secure the maximum compensation available under the law.

Don’t let insurance companies take advantage of your situation. Your recovery is too important to leave to chance. Contact a Rideshare Accident Attorney at Carey Leisure Carney today for a free consultation, and let us fight for the future you deserve.