Uber accident settlement: Your 4-Step Guide

Why Understanding Your Uber Accident Settlement is Critical

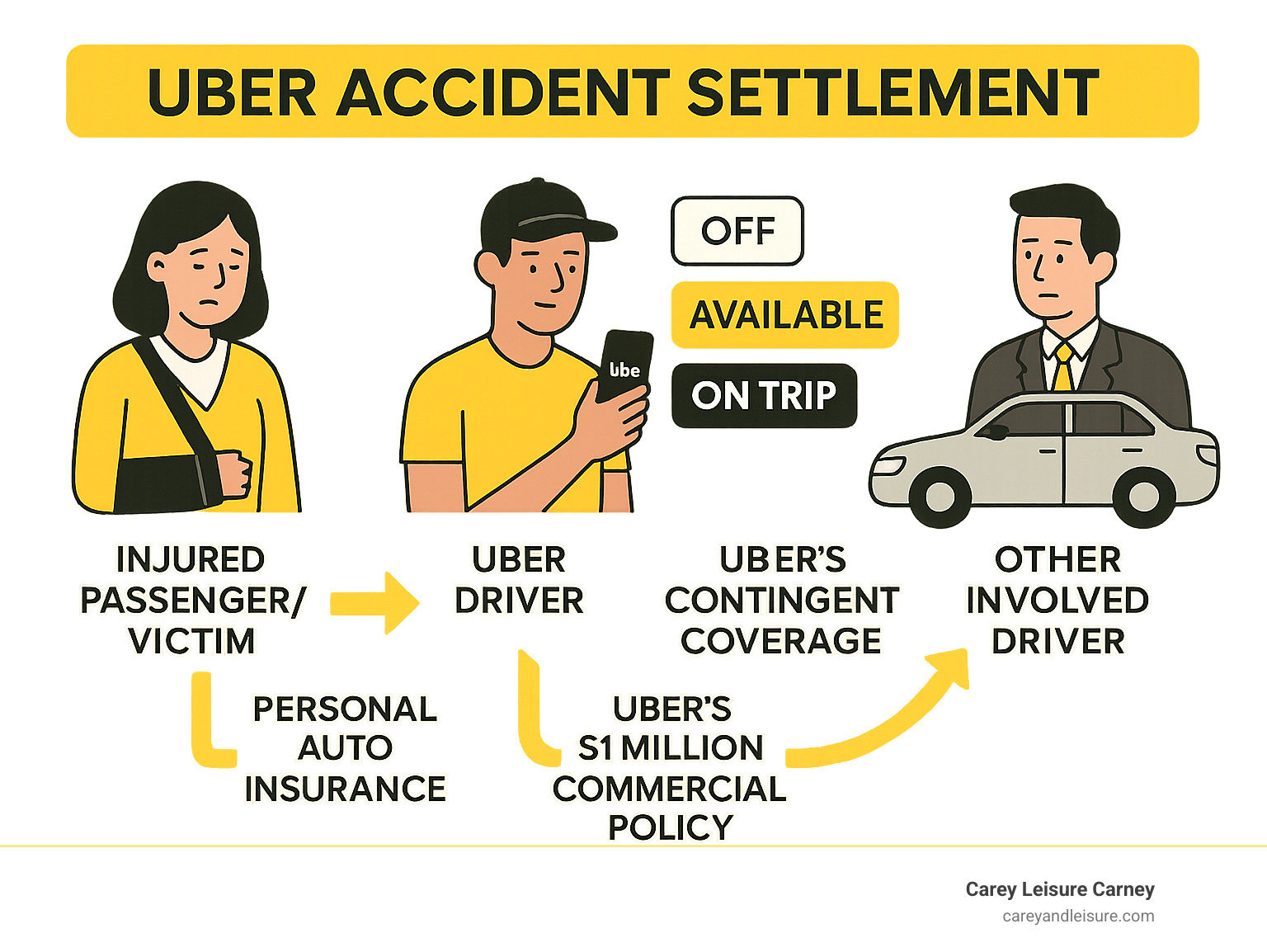

When you’re involved in an Uber accident settlement case, determining your compensation value becomes significantly more complex than a traditional car accident claim. Unlike standard vehicle collisions, Uber accidents involve multiple insurance policies, varying coverage levels based on driver status, and corporate liability considerations that can dramatically impact your final settlement amount.

Quick Settlement Value Overview:

- Minor injuries: $10,000 – $50,000 (whiplash, minor cuts, short-term treatment)

- Moderate injuries: $50,000 – $200,000 (broken bones, herniated discs, extended therapy)

- Severe injuries: $100,000+ (traumatic brain injury, spinal damage, permanent disability)

- Driver status matters: Coverage ranges from $50,000 to $1,000,000 depending on trip phase

- Multiple factors influence value: Medical costs, lost wages, pain and suffering, liability determination

The challenge lies in navigating Uber’s tiered insurance system. When the driver’s app is off, you’re dealing with personal auto insurance. When they’re waiting for passengers, Uber provides limited coverage. But when actively transporting passengers, a $1 million commercial policy kicks in.

Your settlement value depends on proving your damages, understanding which insurance applies, and effectively negotiating with multiple parties. Without proper guidance, you risk accepting far less than your case is worth.

This guide will walk you through each step of determining and securing fair compensation for your Uber accident injuries.

Understanding Uber’s Insurance: How Driver Status Dictates Coverage

An Uber accident settlement is more complex than a standard car crash claim because of Uber’s tiered insurance system. Since drivers are independent contractors, their personal auto insurance often won’t cover accidents that happen while they’re working. To address this, Uber provides different levels of coverage based on the driver’s status at the moment of the accident.

Understanding which policy applies is the key to determining the potential value of your Uber accident settlement. The following table breaks down how Uber’s insurance works.

| Driver Status | Uber’s Coverage | Key Details |

|---|---|---|

| Offline (App is Off) | None | The driver’s personal auto insurance is the sole coverage. Uber provides no commercial coverage. |

| Available (App On, Waiting) | Contingent Liability | If the driver’s personal insurance doesn’t cover commercial activity, Uber provides limited third-party liability: $50,000 per person for injuries, $100,000 per accident, and $25,000 for property damage. This coverage is secondary to the driver’s personal policy. |

| En Route or Transporting (On Trip) | $1 Million Commercial Liability and UIM/UM Coverage | When a ride request is accepted and the driver is en route to pick up a passenger, or actively transporting a passenger, Uber’s robust commercial policy kicks in. This includes $1,000,000 in third-party liability, plus uninsured/underinsured motorist (UIM/UM) coverage. This is the highest level of protection. |

Driver is Offline (App is Off)

If the Uber driver’s app is off, the situation is treated like any other car accident. Uber provides no coverage, and any claims must be filed against the driver’s personal auto insurance policy. However, many personal policies contain a “business use exclusion,” which can complicate matters. For more details on standard auto claims, see our guide on car accident claims.

Driver is Available (App On, Waiting for a Request)

When a driver is logged into the app but has not yet accepted a ride, they are in the “available” phase. Here, Uber provides a limited contingent liability policy that only applies if the driver’s personal insurance denies the claim. The coverage limits are lower:

- Up to $50,000 per person for bodily injury

- Up to $100,000 per accident for bodily injury

- Up to $25,000 for property damage

These lower limits can significantly impact your settlement if your injuries are serious.

Driver is En Route or Transporting a Passenger (On a Trip)

The highest level of coverage applies once a driver accepts a ride request and is on the way to the passenger or has the passenger in the car. During this phase, Uber’s full commercial policy provides a $1 million insurance limit.

This policy includes:

- $1,000,000 in Third-Party Liability Coverage: Covers bodily injury and property damage for others involved if the Uber driver is at fault.

- Uninsured/Underinsured Motorist (UIM/UM) Coverage: Protects the Uber driver and passengers if the at-fault driver has insufficient or no insurance.

This $1 million policy provides a substantial source for compensation in an Uber accident settlement, but accessing it often requires skilled legal navigation.

Key Factors That Determine Your Uber Accident Settlement Value

There is no “average” Uber accident settlement, as each case’s value depends on its unique facts. Your final compensation is determined by calculating all your losses, which fall into two categories: economic damages (quantifiable financial losses) and non-economic damages (pain, suffering, and other quality-of-life impacts). Proving these losses with thorough documentation is essential for securing fair compensation.

Severity of Injuries and Total Medical Costs

Medical expenses are the foundation of your settlement. The more severe the injury, the higher the medical costs and potential compensation. We calculate all related medical expenses, including:

- Immediate costs like ER visits and hospital stays.

- Ongoing treatment such as physical therapy, medications, and surgery.

- Future medical needs for serious injuries like herniated discs or bone fractures, which may require long-term rehabilitation or care.

Minor injuries may result in settlements from $10,000 to $50,000, while severe injuries can lead to settlements well over $100,000, potentially reaching Uber’s $1 million policy limit.

Lost Wages and Diminished Earning Capacity

If your injuries prevent you from working, you are entitled to compensation for lost income. This includes not only the time off work during your recovery but also your future lost income if the injury permanently affects your ability to do your job. This is known as diminished earning capacity. We document these losses using pay stubs, tax returns, and sometimes vocational expert testimony to show the full career impact.

Pain, Suffering, and Emotional Distress

This category compensates you for the non-financial impact of the accident on your life. It covers the physical pain from your injuries, the emotional distress (like anxiety or depression), and the loss of enjoyment of life if you can no longer participate in hobbies or activities you once loved. Attorneys use methods like the multiplier method or per diem method to calculate a value for these damages. Learn more in our guide on Compensation for Pain and Suffering in Florida: What You Need to Know.

Liability and Comparative Negligence

Proving who caused the accident is critical. We investigate police reports, witness statements, and other evidence to establish fault. Florida follows a comparative fault rule, meaning your settlement can be reduced by your percentage of fault. For example, if your damages are $100,000 but you are found 20% at fault, your recovery would be reduced to $80,000. A thorough investigation is crucial to minimize any assigned fault and protect your right to full compensation.

Your Step-by-Step Guide to Securing Fair Compensation

Taking the right steps after an Uber accident can make the difference between a fair Uber accident settlement and leaving money on the table. Being proactive from the start is key to building a strong claim. For a comprehensive overview, see our guide: What to Do After a Car Accident Florida.

Step 1: Immediate Actions After the Accident

Your safety is the top priority. Call 911 immediately to get police and medical professionals on the scene. Adrenaline can mask serious injuries, so it’s crucial to get a medical evaluation, even if you feel “fine.” Accept transport to the hospital if recommended, or see a doctor within 24 hours. Documenting your injuries early creates a clear medical record linking them to the accident, which is vital for your claim.

Step 2: Document the Scene and Gather Evidence

The evidence you gather at the scene can make or break your Uber accident settlement.

- Ensure a police report is filed. Inform the officer that this was an Uber ride.

- Take photos and videos of vehicle damage, the accident scene, road conditions, and any visible injuries.

- Get witness information. Collect names and contact details from anyone who saw the accident.

- Save driver and trip details. Exchange insurance information with all drivers and screenshot your Uber trip details (driver’s name, vehicle, time).

For more on this topic, see our guide on Documenting Evidence in Personal Injury Claims.

What is a Typical Uber Accident Settlement Amount?

While every Uber accident settlement is unique, we can provide realistic ranges based on past cases.

- Minor injuries (whiplash, minor cuts) often settle for $10,000 to $50,000.

- Severe injuries (broken bones, herniated discs, TBI) can exceed $100,000 and may approach the $1,000,000 policy limit available during active Uber trips.

Case examples show this variation: a $75,000 settlement for neck and back injuries; a $100,000 settlement for a pedestrian’s fractured femur; and a $500,000 settlement for a passenger with disabling cervical herniations after a rollover crash. These examples show how injury severity and fault drive the final compensation.

The Claims Process for Your Uber Accident Settlement

After the immediate aftermath, the formal claims process begins.

- Report the accident in the Uber app and to your own auto insurer.

- Avoid giving recorded statements to any insurance company, including Uber’s, until you have spoken with an attorney. These statements can be used to minimize your claim.

- Begin negotiations. An attorney will prepare and send a demand package to the insurer. The initial offer is almost always low. Experienced negotiation is critical to counter this tactic.

Studies show that accident victims with legal representation receive significantly higher settlement offers. An attorney handles all communications and negotiations, fighting for the maximum compensation. For more strategies, read our article on How to Get the Most Compensation From a Car Accident Settlement in Florida.

Frequently Asked Questions about Uber Accidents

Here are answers to the most common questions we receive about Uber accident settlement cases.

How long does it take to settle an Uber accident claim?

There is no set timeline. A simple case with minor injuries might settle in a few months, while a complex case can take much longer. Key factors that affect the timeline include:

- Severity of injuries: We must wait until you reach “maximum medical improvement” to know the full extent of your damages.

- Liability disputes: If fault is unclear or contested, the investigation and negotiation process will take longer.

- Negotiation process: Reaching a fair settlement often involves several rounds of offers and counteroffers with the insurance company.

While filing a lawsuit adds time, it is sometimes necessary to secure fair compensation. An experienced attorney can often streamline the process by managing evidence and negotiating effectively.

How do Uber accident settlements differ from traditional car accident settlements?

Uber accident settlements are significantly more complex than typical car accident claims. The key differences are:

- Corporate Involvement: You are not just dealing with an individual’s insurer but with a large corporation (Uber) and its sophisticated legal and insurance teams.

- Multiple Insurance Layers: As discussed, coverage depends on the driver’s status (offline, available, or on a trip), which can involve multiple policies.

- Higher Policy Limits: The biggest advantage is Uber’s $1 million commercial policy, which provides a much larger source for compensation for serious injuries compared to most personal auto policies.

When can you sue Uber directly for an accident?

While most claims are against an insurance policy, you may be able to sue Uber directly in certain situations. These include:

- Negligent Hiring: If Uber failed to conduct a proper background check on a driver with a history of dangerous driving, the company itself could be held liable for negligence.

- Company Negligence: In rare cases, Uber’s technology or policies could be found to have directly contributed to the accident, such as an app feature that dangerously distracts drivers.

Successfully suing Uber directly requires deep legal expertise and a thorough investigation to build a strong case against their well-funded legal teams.

Conclusion: Taking Control of Your Recovery

Navigating an Uber accident settlement is far more complex than a standard car accident claim due to Uber’s tiered insurance, corporate legal teams, and the need for meticulous documentation. Understanding how driver status, injury severity, and liability impact your case is the first step toward securing the compensation you deserve.

Insurance companies will try to minimize your payout, but studies show that victims with experienced legal representation receive significantly higher settlements. At Carey Leisure Carney, our Board-Certified attorneys—a distinction held by only the top 2% in Florida—have over 100 years of combined experience fighting for accident victims. We know how to counter the tactics of rideshare insurers and build a case for maximum value.

We provide direct attorney access and personalized service to clients in Clearwater, Largo, New Port Richey, Spring Hill, St. Petersburg, and across Florida. Don’t let the complexity of an Uber accident settlement prevent you from getting what you’re owed.

Contact our experienced Uber Accident Attorney for a free consultation today. Let us handle the legal fight while you focus on your recovery.