What is bad faith: Unmask 3 Critical Facts

When Trust Breaks Down: Understanding Your Rights Against Unfair Insurance Practices

What is bad faith in the simplest terms? It’s when your insurance company acts dishonestly or unfairly, such as refusing to honor a legitimate claim, dragging out the process, or putting its profits ahead of your rights. Bad faith means the insurer violated the basic promise of honesty and fair dealing contained in every policy.

Quick Answer:

- General Definition: Bad faith is intentional dishonesty in a transaction, including entering an agreement without intending to fulfill it.

- In Insurance: An insurer acts in bad faith by unreasonably denying or delaying a valid claim, failing to investigate properly, or misrepresenting policy terms.

- Legal Basis: Every insurance contract has an implied covenant of good faith and fair dealing—a legal promise that both parties will act honestly.

- Not the Same As: Bad faith requires intentional or unreasonable conduct. A legitimate claim denial based on policy language or an honest mistake is not bad faith.

When you buy insurance, you expect your insurer to stand by you when disaster strikes. But insurance companies are for-profit businesses, which can lead them to deny valid claims, delay payments, or offer settlements far below what you deserve. This is especially true after an accident when you’re overwhelmed by medical bills and lost income. The insurer has teams of adjusters and lawyers dedicated to minimizing payouts, creating a power imbalance that can feel hopeless. However, Florida law provides protections. When an insurer crosses the line into bad faith, you have legal recourse.

I’m Thomas W. Carey, a board-certified civil trial lawyer. Since 1988, my firm has handled over 40,000 injury matters across Florida, and we’ve seen how insurers use bad faith tactics to deny fair compensation. Our firm exists to level the playing field for people like you.

The Core Concept: What is Bad Faith?

At its heart, bad faith is a lack of honesty and fair dealing. Merriam-Webster defines it as a “lack of honesty in dealing with other people.” In a legal context, it’s even more specific. Cornell Law explains bad faith as “dishonesty or fraud in a transaction,” which can include intentionally failing to fulfill contractual obligations, misleading another party, or entering an agreement without the means or intent to follow through. It is a direct violation of basic standards of honesty. You can learn more about its legal definition here: Definition of bad faith from Cornell Law.

Bad Faith vs. Good Faith

To grasp what is bad faith, it helps to understand its opposite: good faith. Good faith is the expectation that parties in a contract will act honestly and with a sincere intention to uphold their commitments. Every contract, including your insurance policy, contains an “implied covenant of good faith and fair dealing.” This unwritten rule means both parties agree not to do anything that would deprive the other of the contract’s benefits. An insurer acting in good faith diligently investigates claims, makes reasonable settlement offers, and communicates transparently.

Conversely, acting in bad faith is a breach of that implied covenant. It involves intentional misconduct or a deliberate disregard for these principles—not just an honest mistake, but an active attempt to disadvantage the other party.

Bad Faith vs. Negligence and Fraud

It’s crucial to distinguish between bad faith, negligence, and fraud, as they differ in intent.

| Feature | Bad Faith | Negligence | Fraud |

|---|---|---|---|

| Intent | Intentional dishonesty or unreasonable action to avoid obligations. | Lack of reasonable care; an honest mistake. | Intentional deception for personal gain or to cause harm. |

| Knowledge | Knew or should have known actions were unreasonable. | Unaware of potential harm or failed to foresee it. | Knew the representation was false. |

| Behavior | Untrustworthy performance of duties. | Failure to act as a reasonably prudent person would. | Deliberate misrepresentation of facts. |

| Legal Standard | Breach of implied covenant of good faith and fair dealing. | Breach of duty of care. | Intentional misrepresentation, reliance, and damages. |

Negligence is carelessness. An adjuster misplacing a document, causing a delay, is likely negligence, not bad faith. There’s no intent to deceive.

Fraud is deliberate deception for gain. While bad faith can involve deception, it’s broader. An insurer unreasonably delaying a claim is bad faith. If the insurer lies about your policy coverage to deny the claim, that could be both bad faith and fraud.

The key distinction is intent. Bad faith requires intentional dishonesty or unreasonable conduct, while negligence is about carelessness, and fraud is about deliberate deceit.

Bad Faith in the Insurance World

The concept of bad faith is especially significant in insurance. When you pay premiums, you’re buying a promise that your insurer will act in your best interests—a “fiduciary duty.” However, insurance companies are businesses focused on minimizing payouts, which creates a power imbalance between the large corporation and the vulnerable policyholder.

This is where bad faith can occur. When an insurer puts its financial interests above a policyholder’s rights, it can lead to wrongful denials, delays, or underpayments. This can happen in two main scenarios:

- First-Party Claims: When you file a claim with your own insurance company (e.g., for PIP or Uninsured Motorist benefits).

- Third-Party Claims: When an injured party files a claim against another person’s insurer, or when your insurer fails to properly defend you in a lawsuit.

If you suspect your insurer is acting in bad faith, seeking legal guidance is crucial. Our experienced team can help you understand your rights. Find out more here: Bad Faith Insurance Lawyers Near Me.

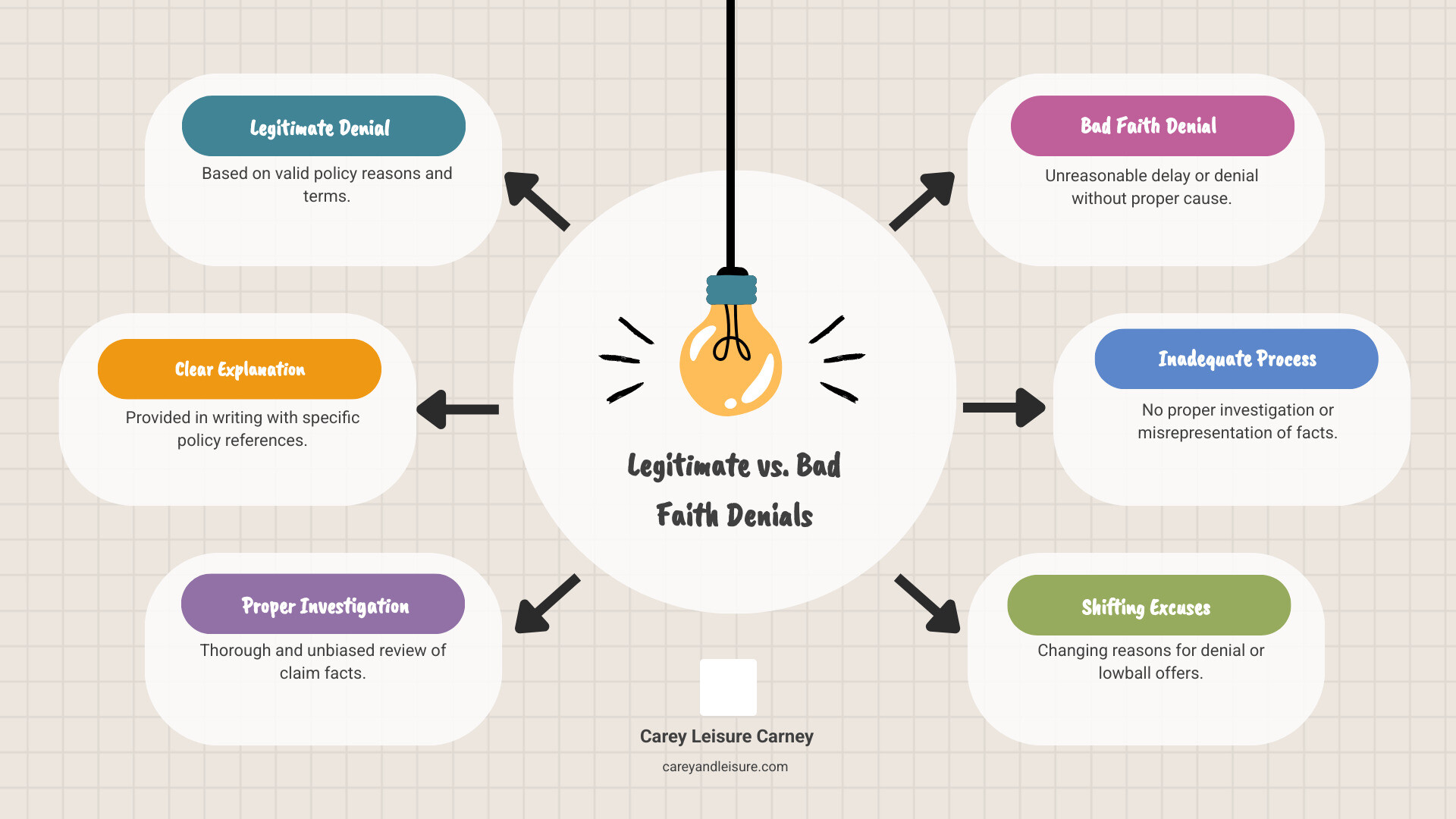

What is bad faith in an insurance context?

In insurance, what is bad faith refers to an insurer’s failure to act fairly and honestly. It’s when an insurance company unreasonably fails to settle a claim when it could and should have. This isn’t about an honest disagreement over a claim’s value; it’s about unreasonable conduct.

Common examples of insurance bad faith include:

- Unreasonable Denial: Denying a valid claim without a proper investigation or a justifiable reason.

- Inadequate Investigation: Failing to conduct a thorough investigation or ignoring evidence that supports the claim.

- Deliberate Delays: Intentionally delaying payment to pressure the policyholder.

- Misrepresentation: Lying about policy coverage or applicable laws to avoid payment.

- Lowball Offers: Offering a settlement that is significantly less than the claim’s true value.

- Failure to Communicate: Not responding to the claimant or failing to explain what information is needed.

These actions breach the trust and contractual obligations an insurer owes its customers. We specialize in holding insurance companies accountable for these practices. Learn more: Lawyers That Sue Insurance Companies.

Florida’s Bad Faith Law

Florida has specific laws to protect policyholders, most notably Florida Statute 624.155. This statute provides a civil remedy when an insurer acts in bad faith.

Under this law, bad faith occurs when an insurer “does not attempt in good faith to settle claims when, under all the circumstances, it could and should have done so, had it acted fairly and honestly toward its insured and with due regard for her or his interests.” The law recognizes the insurer’s duty to treat its policyholder’s interests as fairly as its own.

This statute is a powerful tool, allowing policyholders to sue for damages caused by bad faith conduct—not just the original claim amount. This can include attorney’s fees, interest, and sometimes punitive damages that far exceed the policy limits. The law outlines several “unfair claim settlement practices,” such as:

- Failing to attempt good faith settlements.

- Failing to affirm or deny coverage within a reasonable time.

- Offering substantially less than the amounts ultimately recovered in lawsuits.

You have the right to be treated fairly. For more details, you can review the statute: Florida State Statute 624.155.

Recognizing the Red Flags: Examples of Bad Faith

While insurance companies can protect their interests, they must act in good faith. When they cross that line, a pattern of behavior often emerges. Recognizing these red flags is the first step to protecting your rights.

Here are common tactics that could indicate your insurer is acting in bad faith:

- Unreturned Calls or Emails: A consistent lack of communication from your adjuster.

- Shifting Reasons for Denial: Vague, inconsistent, or changing explanations for denying your claim.

- Excessive Paperwork Requests: Repeatedly asking for documents you’ve already sent to delay the process.

- Threats or Intimidation: An adjuster suggesting you’ll get nothing if you don’t accept a low offer.

- Delaying Investigation: Taking an unreasonably long time to investigate or decide on your claim.

- Misrepresenting Policy Language: Deliberately misinterpreting your policy to deny a covered claim.

These actions are not just frustrating; they can be legally actionable.

In Auto & Personal Injury Claims

After a car accident, you’re dealing with medical treatments, lost wages, and serious injuries. This is when an insurer’s bad faith can be most devastating.

Specific examples of bad faith in Florida auto claims include:

- Denying a Valid Uninsured Motorist (UM) Claim: Your own insurer has a duty to pay your damages if the at-fault driver is uninsured. Denying this claim without a reasonable basis is bad faith.

- Refusing to Settle a Third-Party Claim Within Policy Limits: If you cause an accident, your insurer must try to settle claims against you within your policy limits to protect you from an “excess judgment.” Refusing a reasonable offer can be bad faith.

- Undervaluing Your Claim: Offering significantly less than the actual cost to repair your vehicle or cover your medical bills.

- Delaying PIP Payments: Your Personal Injury Protection (PIP) coverage should promptly pay for medical bills and lost wages. Unreasonable delays constitute bad faith.

- Failure to Provide a Legal Defense: If you are sued after an accident, your insurer typically has a duty to defend you. Refusing to do so can be bad faith.

In Property & Health Insurance Claims

Bad faith also occurs in property and health insurance claims.

Consider these scenarios:

- Denying a Roof Claim Without Proper Inspection: After a Florida hurricane, an insurer denies your roof claim without a thorough inspection or by blaming pre-existing damage without proof.

- Calling a Procedure “Experimental”: Your health insurer denies a doctor-recommended procedure by labeling it “not medically necessary” despite evidence to the contrary.

- Canceling a Policy After a Claim: Your insurer suddenly cancels your policy after you file a claim, citing a minor detail that was not an issue before.

- Misinterpreting Policy Language: An insurer deliberately misinterprets complex clauses to deny coverage, such as claiming damage was from a “flood” (excluded) when it was from “wind-driven rain” (covered).

Your Path Forward: Consequences and Legal Steps

When an insurance company acts in bad faith, it can cause significant financial and emotional distress. Fortunately, Florida law allows victims to seek justice. The consequences for insurers can be severe and often exceed the original claim amount.

These consequences can include:

- Punitive Damages: Awarded to punish the insurer for egregious conduct and deter future bad faith.

- Consequential Damages: To cover additional losses you incurred due to the insurer’s delay or denial, such as lost wages or other expenses.

- Emotional Distress: Compensation for the stress, anxiety, and mental anguish caused by fighting the insurance company.

- Attorney’s Fees and Costs: In Florida, a prevailing policyholder can often have their legal fees paid by the insurance company.

An insurer’s breach of good faith can lead to a separate bad faith lawsuit in addition to a breach of contract claim. You don’t have to accept a wrongful denial. Learn more about fighting back: Don’t Take No For An Answer: Navigating Denied Claims With Legal Counsel.

Steps to Take if You Suspect Bad Faith

If you believe your insurer is acting in bad faith, taking these deliberate steps can strengthen your case.

- Document Everything: Keep a log of every call, email, and letter. Note the date, time, person you spoke with, and what was discussed.

- Keep All Records: Maintain copies of your policy, claim forms, medical records, repair estimates, photos, and all correspondence.

- Communicate in Writing: Use email or certified mail to create a clear paper trail. Follow up phone calls with a summary email.

- Request a Written Denial: If your claim is denied, demand a detailed written explanation citing the specific policy language used to deny the claim.

- Don’t Sign Releases: Never sign a settlement agreement or release without having an attorney review it. You could sign away your right to a bad faith claim.

- Consult an Attorney: Contact a qualified attorney as soon as you suspect bad faith. They can assess your situation and explain your rights.

Why You Need an Experienced Attorney

Fighting a bad faith claim alone is a mistake. Insurance companies have vast legal resources. An experienced attorney levels the playing field.

Here’s why legal help is critical:

- Proving Intent: Bad faith hinges on proving the insurer acted unreasonably. This requires legal expertise to analyze internal documents, which an attorney can obtain through legal findy, and establish a pattern of misconduct.

- Navigating Complex Laws: Bad faith statutes like Florida Statute 624.155 are intricate. Our board-certified attorneys have an in-depth understanding of these laws.

- Calculating Full Damages: A bad faith lawsuit can include compensation for emotional distress and punitive damages. We have the expertise to calculate and demand the full value of your claim.

- Negotiation and Litigation: Insurers are more likely to negotiate fairly with an experienced lawyer. If they don’t, we have over 100 years of combined litigation experience to fight for you in court.

Frequently Asked Questions about Bad Faith

How do you prove an insurance company acted in bad faith?

Proving bad faith requires more than showing your original claim was valid. You must demonstrate that the insurer’s actions were unreasonable and that they knew or should have known their conduct was unreasonable. This involves showing a deliberate or reckless disregard for your rights.

Key evidence often includes:

- Internal Documents: Through legal findy, we can obtain the insurer’s claim manuals, adjuster notes, and internal emails that may reveal a pattern of improper claim handling.

- Communication Logs: Your records of calls and emails can establish a timeline of delays or misrepresentations.

- Expert Testimony: Insurance industry experts can testify about standard practices and how the insurer deviated from them.

- Lack of a Justifiable Basis: We work to show the insurer’s reason for denial was not based on a reasonable investigation or interpretation of the policy.

In Florida, this means proving the insurer failed to attempt in good faith to settle a claim when it should have, had it acted fairly and honestly.

Is every denied insurance claim an act of bad faith?

No. An insurance company has the right to deny claims for legitimate reasons. A denial is not bad faith if it is based on:

- A specific policy exclusion.

- The claim falling outside the scope of coverage.

- Evidence of a fraudulent claim.

- An honest mistake that is quickly corrected.

- A legitimate, good-faith dispute over the value of the damages.

Bad faith arises when the insurer’s conduct is unreasonable, deceptive, or lacks a proper cause, not simply when there is a disagreement.

What is the time limit for filing a bad faith claim in Florida?

The statute of limitations for a bad faith claim in Florida is complex. Generally, a statutory bad faith claim under Florida Statute 624.155 cannot be filed until the underlying insurance claim is resolved in your favor. This means you must first establish that the insurer owed you benefits under the policy.

Because of these legal nuances and critical deadlines, it is crucial to consult with an experienced attorney in Florida as soon as you suspect bad faith. Any delay could jeopardize your ability to recover the full compensation you deserve.

Conclusion

Understanding what is bad faith is crucial for every policyholder. It’s the line between a legitimate business decision and a violation of your rights. Insurance companies have a duty to treat you fairly and honestly. When they fail, Florida law—specifically Statute 624.155—gives you legal recourse.

Recognizing red flags like unreasonable delays, poor investigations, and deceptive communication is the first step. The next is taking decisive action. You are not powerless, and you do not have to fight alone.

At Carey Leisure Carney, our team includes Board-Certified attorneys, a distinction held by only the top 2% in Florida. With over 100 years of combined experience, we offer direct attorney access and personalized service. If you believe you are a victim of an insurer’s bad faith tactics, contact our experienced bad faith insurance lawyers near me for a free consultation. We serve clients across Clearwater, Largo, New Port Richey, Spring Hill, St Petersburg, Trinity, and Wesley Chapel, Florida, and we are ready to fight for you.