Diminished Car Value: Claim Your 3 Rights

Why Your Car’s Value Matters After an Accident

Diminished car value is the permanent loss in your vehicle’s market worth after an accident, even with perfect repairs. This hidden financial loss affects every car owner after a collision, but most don’t know they can recover this money.

Quick Facts About Diminished Car Value:

- Loss Range: Cars can lose 10% to 30% of their value after an accident, with potential losses as high as 50%

- Market Impact: Cars with accident histories sell for up to $1,700 less than clean vehicles

- Dealer Offers: Expect 20% to 30% less when trading in an accident-damaged car

- Universal Effect: Even small accidents reduce your car’s marketplace value

- Permanent Stigma: Every reported accident stays on your car’s history forever

The reality is simple: buyers don’t trust accident-damaged cars. Even with perfect repairs, that accident report on Carfax or AutoCheck follows it forever.

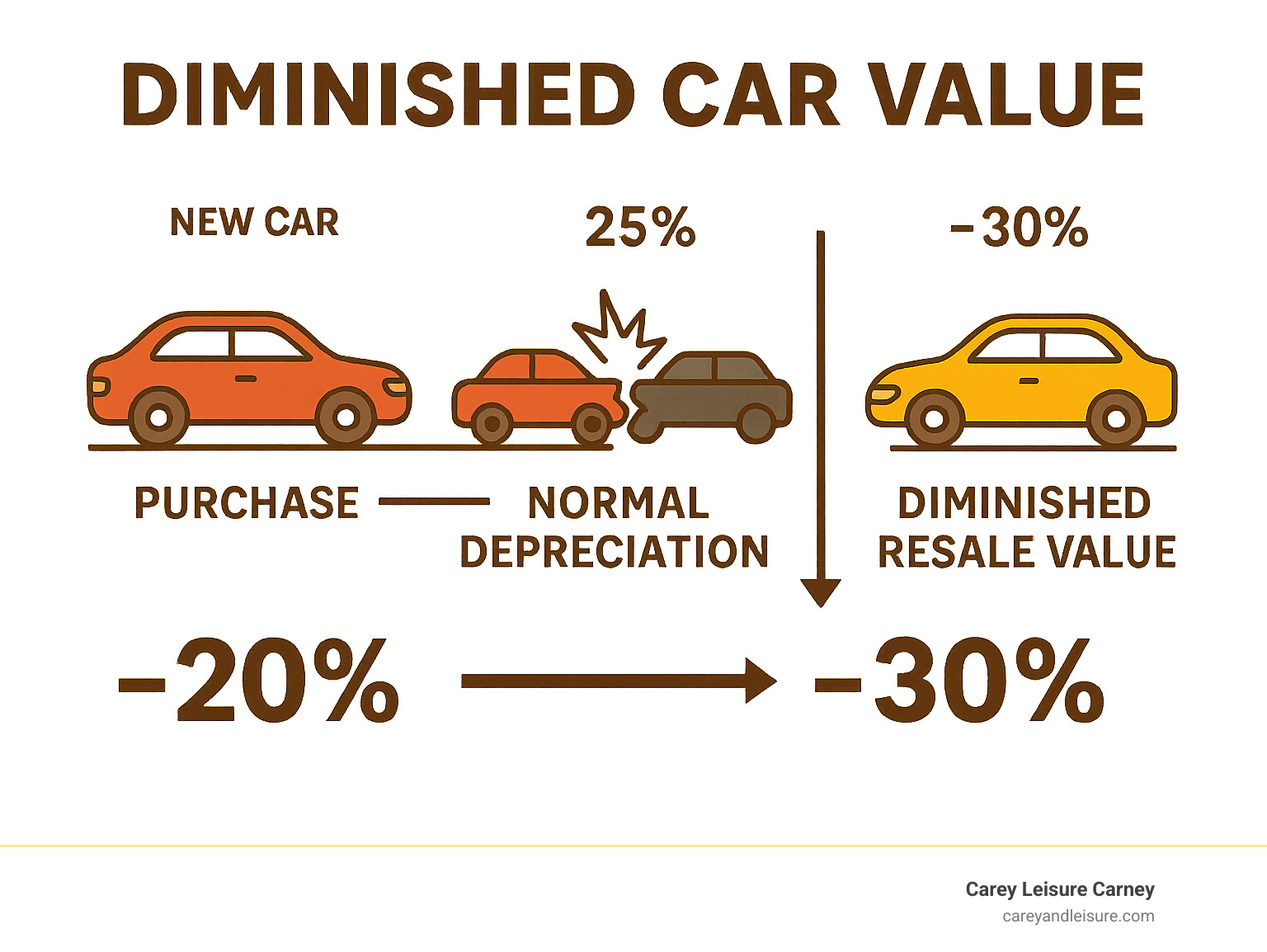

While normal depreciation happens to all cars, diminished value is different. It’s an additional loss caused by the accident itself, beyond regular wear and tear.

Many accident victims don’t realize you have the right to recover this lost value. Insurance companies rarely volunteer this information, but diminished value claims are legitimate in most states, including Florida.

Understanding your rights and acting quickly is key. Insurance adjusters are trained negotiators. Without proper preparation, you’ll likely accept far less than you deserve.

Understanding Diminished Value vs. Normal Depreciation

Your car loses value from the moment you drive it off the lot, but an accident causes a different, more immediate kind of value loss.

Normal depreciation is the expected, gradual loss of value from time, mileage, and general wear and tear. Most cars lose about 20% of their value in the first year alone.

Diminished car value is the permanent loss of value that happens the moment your car is in an accident, even if repairs are perfect. Even if your car looks and drives like new, the accident report on Carfax or AutoCheck creates doubt for potential buyers, who assume something might be wrong.

The key difference is simple: depreciation is due to time, while diminished car value is due to an event. One is gradual and expected; the other is sudden and unfair, especially when the accident wasn’t your fault.

This market perception creates a real financial loss. Buyers worry about hidden damage or future problems, and their hesitation directly impacts your car’s resale value.

The 3 Types of Diminished Value

Understanding the three types of diminished car value helps you build a stronger claim.

Inherent diminished value is the most common type. This is the loss from the stigma of an accident history. Even with perfect repairs, buyers will pay less simply because the vehicle was in a wreck. This buyer distrust creates a real financial loss.

Repair-related diminished value occurs when the repair work itself is flawed. Mismatched paint, new rattles, uneven panel gaps, or the use of aftermarket parts can cause additional value loss beyond the accident stigma.

Immediate diminished value is the drop in your car’s worth right after the accident, before any repairs. While repair costs address the physical damage, this concept illustrates the instant financial impact of a collision.

Each type represents money you’ve lost through no fault of your own. You have the right to recover these losses, especially when another driver caused the accident.

If you’re dealing with an accident in Florida, knowing your next steps is crucial. Our comprehensive guide on What to Do After a Car Accident in Florida walks you through everything you need to protect your rights and maximize your recovery.

How to Calculate Your Car’s Diminished Car Value

Calculating your car’s diminished car value can seem overwhelming, but it’s determined by several key factors. Even perfect repairs can’t erase the accident history.

- Make and model: A luxury or high-demand vehicle will be affected differently than other brands, but all lose value.

- Pre-accident condition: A pristine, well-maintained car will suffer a bigger financial hit than one with existing dings and high mileage.

- Severity of damage: This is critical. A minor scratch won’t hurt your value nearly as much as structural frame damage. Adjusters focus heavily on this.

- Age and mileage: Newer cars with low miles suffer the most dramatic losses because they have more value to lose. A 2023 car with 15,000 miles will take a bigger percentage hit than a 2015 model with 80,000 miles.

The 17c Formula Explained

Insurance companies often use the 17c formula to standardize diminished car value calculations. Originating from a Georgia court case (Mabry v. State Farm), it’s widely used by insurers, though it’s not law everywhere.

The formula has four steps:

- Determine pre-accident value: Use a reliable source like Kelly Blue Book – Car value to find your car’s value before the crash.

- Apply a 10% cap: The formula assumes the maximum loss is 10% of the pre-accident value. For a $25,000 car, the maximum starting loss is $2,500.

- Apply a damage multiplier: This reflects the severity of the damage, ranging from 0.00 for no structural damage to 1.00 for severe structural damage.

- Apply a mileage multiplier: This accounts for wear and tear, with multipliers from 1.00 for low-mileage cars to 0.00 for those over 100,000 miles.

| Damage Multiplier | Severity of Damage |

|---|---|

| 0.00 | No structural damage |

| 0.25 | Minor damage to structure/panels |

| 0.50 | Moderate damage to structure/panels |

| 0.75 | Major damage to structure/panels |

| 1.00 | Severe structural damage |

| Mileage Multiplier | Mileage Range |

|---|---|

| 1.00 | 0 – 19,999 miles |

| 0.80 | 20,000 – 39,999 miles |

| 0.60 | 40,000 – 59,999 miles |

| 0.40 | 60,000 – 79,999 miles |

| 0.20 | 80,000 – 99,999 miles |

| 0.00 | 100,000+ miles |

For example, a car worth $30,000 with minor structural damage and 45,000 miles: The $3,000 base value (10%) is multiplied by the damage modifier (0.25) and the mileage modifier (0.60), resulting in a diminished value of just $450.

The catch: The 17c formula often lowballs your actual loss. Appraisers and attorneys argue it undervalues the real market loss. Insurers aren’t required to use it, but they prefer it for its lower payouts. This is a starting point for negotiations, not the final word.

How to File a Claim: A Step-by-Step Guide

Filing a diminished car value claim is about recovering what’s rightfully yours. You shouldn’t have to absorb a financial loss from someone else’s mistake. The process involves filing with the at-fault party’s insurance company, whose liability coverage should compensate you for your car’s lost market value. Be prepared to negotiate, as adjusters are trained to settle claims for as little as possible.

Understanding how insurance companies operate gives you an advantage. To learn more about their tactics, see our guide on The Role of Insurance Companies in a Car Accident.

Key Documentation for Your Diminished Car Value Claim

Success requires solid evidence. The more documentation you have, the stronger your position.

- Police Report: The official, neutral record of the accident, identifying fault and initial damage.

- Repair Estimates and Invoices: Keep all estimates, bills, and parts lists to prove the extent of damage and repairs.

- High-Quality Photos: Take pictures immediately after the accident and again after repairs. “Before” photos are also valuable. Visual evidence is powerful.

- Professional Appraisal Report: This can make or break your claim. A certified appraiser determines the pre- and post-accident value. It’s often a worthwhile investment for significant claims.

- Vehicle History Report: A Carfax or AutoCheck report proves the accident is on your car’s permanent record.

- Comparable Sales Data: Research similar vehicles with and without accident histories. The price gap is compelling evidence.

- Demand Letter: A formal demand letter to the insurer stating your claim amount and including all supporting documents.

When and How to File Your Claim

Timing is critical. File your diminished car value claim promptly after repairs are completed. Waiting makes it harder to prove the accident-related loss versus normal depreciation.

- Know Your State’s Laws: In Florida, you can pursue diminished value claims against the at-fault driver’s insurance. Knowing local rules gives you an edge.

- Statute of Limitations: Florida’s statute of limitations for property damage is four years, but acting sooner protects your interests and shows the insurer you’re serious.

- Contact the Insurer: Call the at-fault driver’s insurance company to state your intent to file a diminished value claim and ask about their procedures.

- Submit Documentation: Present your documentation professionally and completely. A well-organized claim will stand out.

- Negotiate: Their first offer will likely be low. Use your evidence to support your counteroffer and be prepared to negotiate.

If you weren’t at fault, you have specific rights. Our guide What to Do After Car Accident That’s Not Your Fault explains how to protect yourself.

Common Problems and When to Get Legal Help

Filing a diminished car value claim isn’t always smooth. Even with perfect documentation, insurance companies use tactics to minimize payouts. Common roadblocks include:

- Lowball Offers: Insurers often make low initial offers, hoping you’ll accept quickly rather than fight for what you deserve. Accepting could mean leaving thousands of dollars on the table.

- Claim Denials: They might deny your claim by arguing the damage wasn’t severe, repairs restored the value, or the car was too old. They may even illogically claim severe structural damage invalidates a claim.

- Complex Negotiations: Adjusters are skilled negotiators. Without knowledge of your rights, you’re at a significant disadvantage.

- State-Specific Laws: While Florida allows these claims, understanding the specific rules is key to success.

- Leased Vehicles: With a leased car, the leasing company is the injured party, which complicates the claim process.

- Uninsured/Underinsured Drivers: Your ability to recover depends on your own policy. Our guide on Uninsured vs. Underinsured Motorist Coverage Explained provides more insight.

Why You Should Consider an Auto Accident Attorney

Diminished car value claims get complicated fast. An experienced attorney often means the difference between a fair settlement and getting shortchanged. Here’s how they help:

- Complex Calculations: An attorney works with independent appraisers to ensure your claim reflects the true loss, not a lowball estimate from a formula.

- Proving Your Loss: They know what evidence—repair records, appraisals, market data—is most effective with insurance companies.

- Negotiating with Adjusters: Adjusters use tactics to minimize payouts, counting on your inexperience. Our Board-Certified attorneys have decades of experience countering these tactics.

- Understanding Legal Nuances: Knowing Florida’s specific laws and precedents can make or break your claim.

- Maximizing Compensation: You shouldn’t have to accept less than fair compensation just because the process is complicated.

At Carey Leisure Carney, our Board-Certified attorneys bring over 100 years of combined experience to auto accident claims, including diminished car value cases. We offer direct attorney access and personalized service throughout Florida, including Clearwater, Largo, New Port Richey, Spring Hill, St. Petersburg, Trinity, and Wesley Chapel.

Being Board-Certified means we’re in the top 2% of attorneys in Florida—a distinction from proven expertise. That level of experience can make all the difference. Learn more on our Auto Accident Attorney page.

Frequently Asked Questions about Diminished Car Value

Here are answers to common questions about diminished car value claims, which can help you avoid costly mistakes.

Can I claim diminished value if the accident was my fault?

Probably not. If you caused the accident, you generally cannot claim diminished value from your own insurer. Your collision coverage pays for repairs (minus your deductible), but not for the subsequent loss in value.

However, there is an exception. Under Florida’s comparative negligence system, if another party shares fault, you might recover a portion of the diminished value from their insurance, based on their percentage of fault. If you’re 100% at fault, focus on quality repairs. If fault is shared, consult an attorney.

How long do I have to file a diminished value claim in Florida?

Florida gives you four years from the accident date to file a property damage claim. However, don’t wait. The sooner you act, the better.

Waiting hurts your case because evidence gets stale, your car continues to depreciate normally, and insurers become more skeptical of delayed claims. Ideally, file your claim 30-60 days after repairs are complete. Your documentation will be fresh and the insurer’s file will be active.

Is it worth filing a claim for an older car with high mileage?

It depends, but often it’s not worth it. Cars with over 100,000 miles get a zero multiplier in the 17c formula, and those with 80,000-99,999 miles get a very low one.

However, the 17c formula isn’t absolute. A well-maintained luxury, classic, or high-resale-value older car might still have a viable claim, especially if the damage was severe. Consider that a professional appraisal costs $300-$800; if the appraisal costs more than the potential recovery, it’s not worth pursuing.

If your car is worth under $15,000 with over 80,000 miles, a claim is likely not worth the effort. If unsure, a consultation with an attorney can clarify your options.

Get the Compensation You Deserve

You now understand a critical concept most accident victims miss: your car’s hidden financial loss and your right to recover it. Diminished value is a real loss that occurs the moment an accident is reported. Perfect repairs can’t erase the Carfax report, and buyers know it.

You have the right to be made whole after an accident caused by someone else’s negligence. This means recovering the market value the accident stole, not just fixing the dents.

The insurance company won’t volunteer this information. They hope you’ll accept the repair check and move on, unaware you may be entitled to more. Now you know better.

Acting promptly is crucial. Evidence fades, and Florida’s four-year statute of limitations is firm. Filing your claim sooner strengthens your position.

Insurance adjusters are trained negotiators who handle these claims daily to minimize payouts. Without legal expertise, you are at a significant disadvantage.

At Carey Leisure Carney, our Board-Certified attorneys have over 100 years of combined experience fighting for accident victims. We understand insurance company tactics and know how to counter them. We handle the calculations, gather expert appraisals, and negotiate with adjusters for you.

Don’t let the insurance company shortchange you on your diminished car value claim. Contact us today for a free consultation about your Diminished Value Claims in Florida. You’ve been through enough. Let us help you get the compensation you deserve.