Lyft Legal Issues: 3 Critical Warnings

Why Lyft Legal Issues Matter for Drivers, Passengers, and Injured Parties

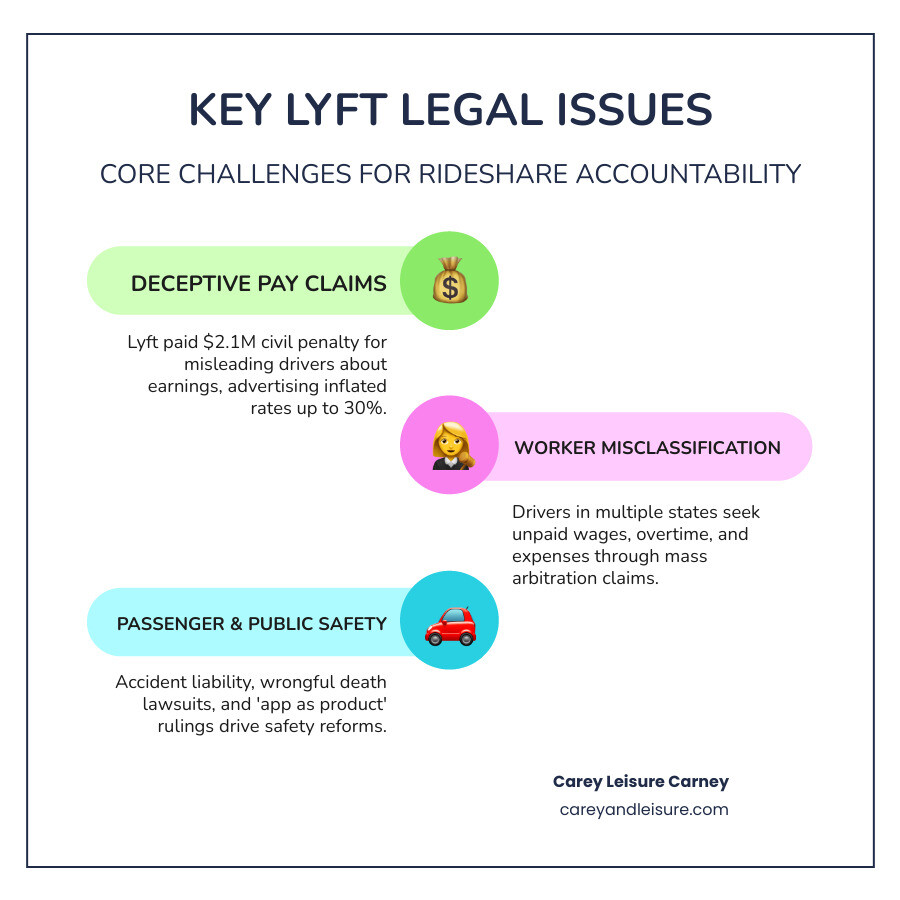

Lyft legal issues span three critical areas that affect both drivers and passengers: deceptive earnings claims that misled drivers about their income potential, worker misclassification disputes over whether drivers are employees or independent contractors, and safety concerns including accidents, assaults, and app-related liability. In 2025, these legal battles have resulted in millions in penalties, ongoing lawsuits across multiple states, and new precedents that hold rideshare companies accountable for harm caused by their platforms.

Key Lyft Legal Issues at a Glance:

- Deceptive Pay Claims – Lyft agreed to pay $2.1 million in civil penalties for misleading drivers about earnings, advertising rates based on the top 20% of drivers and inflating income by up to 30%

- Worker Misclassification – Drivers in Washington, Oregon, Massachusetts, New York, and Illinois are pursuing mass arbitration claims for unpaid wages, overtime, and expense reimbursement

- Accident Liability – Insurance coverage varies by driver’s app status, with up to $1 million in coverage when a ride is active, but gaps exist when drivers are simply logged in

- Safety Reforms – Shareholder lawsuits have forced Lyft to improve passenger safety features, driver training, and 24/7 reporting mechanisms

- App as “Product” – A Missouri court ruled that Lyft’s app can be considered a defective product in wrongful death cases, opening new avenues for liability

If you’ve been injured in a Lyft accident, misled about driver earnings, or deactivated without proper notice, you may have legal recourse. The complexity of rideshare insurance, the ongoing classification debates, and new product liability rulings mean that understanding your rights requires specialized knowledge.

As Thomas W. Carey, a board-certified civil trial lawyer with over three decades of experience in personal injury cases, I’ve guided thousands of injury matters across Florida and understand the unique challenges posed by Lyft legal issues. Our firm has secured multi-million-dollar results in motor-vehicle, negligence, and wrongful death cases, and we’re committed to helping injured parties steer the complexities of rideshare accidents and corporate accountability.

Lyft legal issues glossary:

Deceptive Earnings Claims: The FTC and DOJ Crackdown

One of the most significant Lyft legal issues recently addressed involves allegations of misleading drivers about their potential earnings. The Justice Department and the Federal Trade Commission (FTC) took decisive action against Lyft, accusing the rideshare giant of deceptive marketing practices that lured prospective drivers with inflated income promises. This isn’t just a slap on the wrist; it’s a clear signal from federal regulators that gig economy companies must play fair with their workforce. For more information about the FTC’s role in consumer protection, you can visit their website: More info about the FTC’s role in consumer protection.

The specific allegations centered on Lyft making false and misleading statements in its advertisements and marketing materials. These claims often presented an unrealistic picture of what drivers could truly earn, creating false expectations and, ultimately, financial hardship for many. The result? Lyft agreed to pay a substantial $2.1 million civil penalty to resolve these allegations.

But the penalty wasn’t the only outcome. Lyft is now subject to a permanent injunction, which is a court order prohibiting the company from making similar misleading claims in the future. This injunction mandates that Lyft must base its earnings claims on typical earnings, back up all claims with evidence, and clearly notify drivers about the terms of any incentive offers. This is a crucial step towards greater transparency for gig workers across the country.

How Lyft Allegedly Inflated Driver Pay

So, how exactly did Lyft allegedly mislead drivers? The core of the deception lay in two primary areas: how they calculated advertised hourly earnings and the nature of their “Earnings Guarantees.”

Firstly, Lyft’s advertisements for driver positions in various markets often touted impressive hourly earnings. However, these figures were not representative of what the average driver could expect. Instead, they were based on the top 20% of drivers’ earnings. This practice significantly overinflated actual earnings, sometimes by as much as 30% for most drivers. Imagine seeing an ad promising $40 an hour, only to find that the vast majority of drivers were making closer to $28. This kind of disparity creates a serious problem for individuals trying to make informed decisions about their livelihood.

Furthermore, these inflated hourly rates often included tips, which were not always clearly disclosed as part of the advertised amount. By factoring in tips and using the highest-earning drivers as their benchmark, Lyft created a distorted image of potential income. The FTC’s complaint highlighted that these advertised figures also included time when drivers were simply logged into the app, not actively giving rides, further skewing the perception of productive earning hours.

The impact of these misleading claims was not minor. Lyft received tens of thousands of driver complaints regarding misleading “Earnings Guarantees” between January 2021 and April 2022. This volume of complaints underscores the widespread confusion and frustration among drivers who felt shortchanged and deceived.

The “Earnings Guarantee” Payout Structure

The second major area of deception involved Lyft’s “Earnings Guarantees.” These promotions promised drivers a specific amount if they completed a certain number of rides within a given timeframe. For instance, an offer might state, “Earn $975 if you complete 45 rides this weekend.” Sounds like a bonus, right? That’s precisely what many drivers believed.

However, the actual payout structure was far more nuanced, and often, drivers were paid only the difference between what they otherwise earned and Lyft’s advertised guaranteed amount. This means if a driver already earned $900 from fares for completing 45 rides, and the guarantee was $975, they would only receive an additional $75. They would not receive the full $975 in addition to their regular earnings.

This payout structure was frequently misunderstood by drivers, who often perceived the guarantee as a lump-sum bonus. The terms were not clearly disclosed, leading to significant driver confusion and disappointment. Drivers often expressed frustration, feeling that the wording of these guarantees was deceptive. For example, one driver complained about an offer stating “complete 15 rides I would instantly receive an extra $125,” only to find they did not receive it as expected. Another noted that an offer to “complete 220 rides and get 3,500” actually meant “get the difference of what you make while driving,” not a lump sum. This kind of ambiguity, especially after receiving a Notice of Penalty Offenses in October 2021, highlighted a pattern of behavior that federal regulators found unacceptable.

The Core of Lyft Legal Issues: Driver Misclassification

Perhaps the most enduring and impactful of all Lyft legal issues is the ongoing debate over driver classification: are Lyft drivers independent contractors or employees? This question isn’t just about semantics; it has profound implications for drivers’ rights, benefits, and the entire business model of gig economy companies.

Lyft, like Uber, firmly classifies its drivers as independent contractors. This classification is incredibly advantageous for the company. If drivers were employees, Lyft would likely have to raise prices for riders, be less flexible with drivers’ schedules, and limit drivers’ ability to work for other platforms. More importantly, it would mean paying minimum wage, overtime, covering business expenses, and providing benefits like health insurance and workers’ compensation. This is why Lyft continues to fight vehemently to maintain the independent contractor status of its drivers.

However, just because a company says you’re an independent contractor, or even gives you a 1099 tax form, doesn’t mean you legally are one. Attorneys and regulators argue that the level of control Lyft exerts over its drivers suggests an employer-employee relationship. This debate has fueled numerous lawsuits and regulatory actions across the country, aiming to reclassify drivers and secure them the protections afforded to employees.

This battle over classification has even led to innovative legal strategies, such as “mass arbitration.” When traditional class action lawsuits become difficult due to mandatory arbitration clauses in driver agreements, mass arbitration allows a large group of individuals to pursue individual arbitration claims against a company for the same issue. This approach helps drivers collectively seek compensation for alleged misclassification and unpaid wages.

Legal Arguments and Precedents

The legal arguments surrounding worker classification hinge on various “tests” and criteria at both the federal and state levels. While the specifics can vary, a key factor is almost always the level of control a company has over a worker. Essentially, the more control a company exercises over how, when, and where a person performs their work, the more likely that person is to be considered an employee.

Federal tests, often guided by IRS guidelines, examine factors like behavioral control (instructions, training), financial control (expenses, investment), and the type of relationship (benefits, permanency). Similarly, state laws, such as California’s “ABC test” (though specific to California, it illustrates the type of criteria used), look at whether the worker is free from the company’s control, performs work outside the usual course of the company’s business, and is engaged in an independently established trade or business.

This debate has been going on for years, with attorneys suspecting many Lyft drivers have been misclassified. The U.S. Supreme Court’s decision to decline hearing Uber and Lyft’s challenge to California’s driver lawsuits earlier this year is a significant development. While not a ruling on the merits of classification itself, it means that California’s legal actions against the companies for alleged misclassification can proceed. This decision underscores the ongoing legal vulnerability of rideshare companies on this front and could influence similar cases in other states, including Florida.

Potential Damages and Compensation for Drivers

If drivers are ultimately reclassified as employees, or if a settlement is reached based on misclassification, the potential damages and compensation they could recover are substantial. These often include:

- Unpaid Wages: Compensation for hours worked below minimum wage.

- Overtime Pay: For hours worked beyond the standard workweek, which independent contractors typically aren’t entitled to.

- Expense Reimbursement: Drivers, as independent contractors, currently bear the full cost of their operations, including gas, vehicle maintenance, insurance, and phone data. As employees, these would likely be reimbursable expenses.

- Missed Benefits: Access to benefits typically provided to employees, such as health insurance, paid time off, and contributions to social security and unemployment insurance.

It’s estimated that successful claims in some of these mass arbitration efforts could be worth $2,000 or more per driver, depending on the specific circumstances and hours worked. For many drivers, these amounts represent a significant recovery that could alleviate financial burdens incurred while working for the platform. If you’ve been in an accident and are also dealing with these employment status questions, seeking guidance from an attorney is crucial. For more information on what to do if you’re in an accident, please see our guide: More info on what to do if you’re in an accident.

Safety, Liability, and Accidents: When Rides Go Wrong

Beyond earnings and employment status, Lyft legal issues also frequently involve safety, liability, and accidents. When rides go wrong, whether through a car accident, an assault, or other incident, the question of who is responsible can become incredibly complex. This is particularly true in Florida, where we see the impact of these incidents on individuals and families.

Passenger safety has been a recurring concern, leading to shareholder lawsuits against Lyft. These lawsuits alleged that Lyft’s officers and directors failed to adequately address driver assaults on passengers. In response, Lyft agreed to implement several safety and governance reforms. This includes boosting passenger awareness of the “Alert 911 Silently” feature on the app and making it easier to report problems 24/7 to a live human. They also committed to improving driver training and enhancing the company’s code of business conduct and ethics. These reforms are a direct result of legal pressure and aim to make the platform safer for everyone.

Of course, car accidents involving Lyft drivers are a major area of concern for us here in Florida. The proliferation of rideshare services means a higher likelihood of encountering a rideshare vehicle on the road. When an accident happens, determining liability and navigating insurance claims can be a maze. A complete guide from a Rideshare Accident Lawyer can be found here: A complete guide from a Rideshare Accident Lawyer.

The App as a “Product”: A New Frontier in Liability

In a groundbreaking development, a Missouri Court of Appeals recently ruled that a rideshare app can be considered a “product” subject to product liability laws. This ruling stemmed from a wrongful death lawsuit against Lyft, alleging that defects in the app’s design contributed to a passenger’s death. The case involved individuals who created a fake identity and used anonymous payment methods through the Lyft app to lure the victim to his death. The court found that if the app’s design allowed for such unchecked identity creation, it could be considered a defective product.

This precedent-setting decision is significant because it opens a new avenue for accountability. Traditionally, rideshare companies have argued that their apps are merely service platforms, not tangible products, shielding them from product liability claims. However, this ruling suggests that if an app’s design or functionality directly leads to harm, the company could be held liable. This could have far-reaching implications for future lawsuits in Florida and across the country, especially in cases involving user identity verification failures or other app-related security flaws.

Safety and Governance Reforms

As mentioned, in addition to the app-as-product ruling, Lyft has agreed to implement several safety and governance reforms to settle a shareholder lawsuit related to driver assaults. These reforms aim to improve the safety experience for both passengers and drivers:

- “Alert 911 Silently” Feature: Lyft committed to boosting passenger awareness of this feature, which allows users to discreetly alert emergency services through the app.

- 24/7 Problem Reporting: Making it easier for users to report problems at any time to a live human, ensuring immediate assistance when needed.

- Improved Driver Training: Improved training programs for drivers to better handle difficult situations and understand safety protocols.

- Improved Background Checks: While details are often proprietary, the pressure from these lawsuits points to continuous improvement in vetting drivers.

These changes reflect a growing recognition that rideshare companies have a responsibility to ensure the safety of their users, not just facilitate rides. For more specific details on how these issues impact car accident settlements, you can refer to our comprehensive guide: Details on Lyft car accident settlements.

Navigating Your Legal Options After a Lyft-Related Incident

Given the array of Lyft legal issues, understanding your legal options after an incident can feel overwhelming. Whether you’re a driver dealing with earnings discrepancies or a passenger injured in an accident, knowing how to steer the legal landscape is crucial.

Our firm, Carey Leisure Carney, understands the complexities of these cases. We’re here to help you explore your legal recourse, which often begins with thoroughly documenting the incident and seeking prompt legal advice. As we always say, if you’ve been in an accident that wasn’t your fault, know your rights. You can find out more here: What to do if you’re in an accident that’s not your fault.

Key Lyft Legal Issues for Drivers

For drivers, the primary Lyft legal issues often revolve around:

- Misclassification Claims: As discussed, the debate over independent contractor versus employee status can significantly impact a driver’s earnings and benefits. If you believe you’ve been misclassified, you might be entitled to back pay, overtime, and reimbursement for expenses.

- Unpaid Wages: This ties directly into misclassification. If you were working as an employee but paid as a contractor, you might have claims for unpaid minimum wage or overtime.

- Mass Arbitration Process: Due to arbitration clauses in Lyft’s terms of service, pursuing individual arbitration claims through a mass arbitration process is a common strategy for drivers seeking compensation for misclassification.

- Deactivation Appeals: Lyft’s settlement in a California lawsuit (though not applicable to Florida specifically, the principles are relevant) included provisions for drivers to receive notice before deactivation and an opportunity to address issues. While the specifics may vary by state, understanding your rights regarding deactivation is critical.

Understanding Lyft Legal Issues and Insurance Coverage

For anyone involved in a Lyft accident in Florida, understanding the nuances of insurance coverage is paramount. This is where things get particularly complex, as coverage can vary dramatically based on the driver’s “app status” at the time of the incident:

- Driver’s App is Off: If the Lyft driver is not logged into the app, their personal auto insurance policy applies. In Florida, this means they must carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage. For more information on PIP insurance in Florida, visit: What is PIP Insurance in Florida?.

- Driver’s App is On, Waiting for a Ride: When the driver is logged into the Lyft app and waiting for a ride request, but has not yet accepted one, Lyft provides limited liability coverage. Under Florida’s transportation network company (TNC) statute, this typically includes $50,000 for bodily injury per person, $100,000 for bodily injury per accident, and $25,000 for property damage.

- Driver Has Accepted a Ride or Has a Passenger: This is when the highest level of coverage kicks in. Once a ride is accepted, or a passenger is in the vehicle, Lyft’s robust $1 million commercial insurance policy is typically active. This policy covers bodily injury, death, and property damage.

It’s critical to note that while Lyft’s $1 million policy sounds comprehensive, insurance companies, including those for rideshare platforms, may try to limit their payout. This is why having an experienced personal injury attorney on your side is so important, especially in Florida, where we understand the intricacies of our state’s TNC statutes and insurance laws. We can help you determine which policy applies and fight to ensure you receive the compensation you deserve.

Frequently Asked Questions about Lyft’s Legal Battles

Can I sue Lyft directly if I’m in an accident with one of their drivers?

Generally, claims are first made against the driver’s and Lyft’s applicable insurance policies. Direct lawsuits against Lyft for an accident often involve proving the company’s own negligence, such as in hiring or retaining a dangerous driver, or if the app itself is proven to be a defective “product” that caused the harm. A personal injury attorney can evaluate the specifics of your case.

In Florida, our TNC statute outlines the insurance responsibilities of rideshare companies. While the law primarily focuses on insurance coverage based on the driver’s app status, there can be exceptions where Lyft itself might be directly liable. For instance, if Lyft was negligent in its hiring, training, or retention of a driver with a known history of unsafe behavior, or if, as the Missouri court precedent suggests, a design defect in the app directly contributed to the accident, a direct lawsuit against Lyft could be pursued. This requires a thorough investigation and understanding of both Florida law and evolving legal precedents.

What is the main difference between how Lyft and Uber have handled driver lawsuits?

While both companies face similar legal challenges regarding driver classification, some reports and settlements suggest different approaches. For example, a 2016 settlement saw Lyft provide drivers with more protections and pay arbitration costs without reclassifying them, while Uber has faced separate, large-scale litigation. Both, however, consistently fight to maintain drivers’ independent contractor status.

In the context of driver classification, there’s a perception among some driver advocates that Lyft, at times, has been slightly more willing to engage in settlements that offer certain driver protections, even if it stops short of full employee reclassification. For instance, one attorney representing drivers noted receiving significantly fewer complaints from Lyft drivers compared to Uber drivers regarding pay and deactivation issues. However, both companies remain staunch in their position that drivers are independent contractors, making the fundamental legal battle a shared one.

Are Lyft drivers officially considered employees or independent contractors?

This remains one of the most contentious and ongoing legal battles for Lyft. Legally, Lyft classifies its drivers as independent contractors. However, numerous lawsuits in states like California and Massachusetts, along with federal regulatory actions, challenge this classification, arguing the control Lyft exerts over drivers makes them de facto employees. The final determination varies by state and is subject to constant legal challenges.

In Florida, the state’s TNC statute acknowledges rideshare drivers as independent contractors. However, this statutory classification doesn’t necessarily shield Lyft from all challenges, especially concerning federal labor laws or specific state-level interpretations of employment standards. The debate hinges on the level of control Lyft exercises, which attorneys argue dictates an employer-employee relationship, regardless of how the company labels its drivers. This ongoing legal ambiguity means that the classification of Lyft drivers is far from settled and continues to be a central point of contention in courts across the nation.

Conclusion

The legal landscape surrounding Lyft is complex and constantly evolving, touching on crucial aspects of driver compensation, worker classification, and passenger liability. From federal crackdowns on deceptive earnings claims to groundbreaking rulings on app product liability, Lyft legal issues directly impact the lives of drivers, passengers, and other individuals on our roads.

At Carey Leisure Carney, we believe in holding corporations accountable and protecting the rights of individuals. With Board-Certified attorneys (a distinction held by only the top 2% in Florida) and over 100 years of combined experience, we offer direct attorney access and personalized service to guide you through these intricate legal challenges. If you have been involved in a rideshare accident in Clearwater, Largo, New Port Richey, Spring Hill, St Petersburg, Trinity, Wesley Chapel, or anywhere in Florida, we are here to help. Contact us today for a free consultation. Our mission is to ensure you receive the full compensation you deserve.

If you have been involved in a rideshare accident, contact an experienced auto accident attorney.