Lawyers That Sue Insurance Companies: Unmasking Denials 2025

Why Understanding Legal Action Against Insurers Is Critical for Your Financial Recovery

Lawyers that sue insurance companies are specialized attorneys who fight for policyholders when insurers wrongfully deny, delay, or underpay legitimate claims. These legal professionals handle bad faith insurance cases and breach of contract disputes, helping you recover policy benefits, emotional distress compensation, and punitive damages.

When You Need a Lawyer to Sue Your Insurance Company:

- Your claim was denied without a valid reason.

- The insurer delayed payment unreasonably.

- You received a lowball settlement offer.

- The company misrepresented your policy terms.

- They failed to properly investigate your claim.

- You’re dealing with uninsured motorist disputes.

Insurance companies employ teams of lawyers and adjusters to minimize payouts. As one client shared: “When you have been injured in an accident or suffered property damage, you reach for the safety net of your insurance policy. The denial of your claim is like reaching for that safety net and finding it missing.”

While most claims are paid without issue, many policyholders must resort to litigation when they believe their insurer has acted in bad faith. Insurers may deny claims without good reason or use tactics to dispute benefits, especially against those who can’t fight back.

As Thomas W. Carey, a board-certified civil trial lawyer who has guided roughly 40,000 injury matters across Florida, I’ve seen how lawyers that sue insurance companies level the playing field. My experience includes securing multi-million-dollar results against insurers who initially denied or underpaid valid claims.

Understanding Insurance Company Denials: Legitimate Reasons vs. Bad Faith

When disaster strikes, you expect your insurance company to provide the safety net you’ve paid for. But insurers are businesses focused on profits, and sometimes that means unfairly denying your claim. The key is to distinguish between a legitimate denial and an act of bad faith.

Your insurance policy is a contract that legally requires the company to act with a “duty of good faith” and fair dealing. When they breach this duty, it’s considered bad faith, and you may be entitled to compensation beyond your original claim. You can learn more about how this applies to your situation on our Bad Faith page. The dynamics also vary by claim type, as we explore in The Role of Insurance Companies in a Car Accident.

What Constitutes “Bad Faith” by an Insurer?

Bad faith occurs when an insurer avoids, delays, or underpays a valid claim without justification. Common bad faith tactics include:

- Misrepresenting policy terms: Twisting policy language or telling you something isn’t covered when it is, betting you won’t read the fine print.

- Unreasonable delays: Deliberately dragging out the claims process, hoping you’ll give up or accept a low offer out of desperation.

- Inadequate investigation: Denying a claim based on a biased, incomplete, or rushed investigation.

- Lowball settlement offers: Offering far less than your claim is worth, knowing you’re under financial pressure.

- Threatening policyholders: Using intimidation to discourage you from pursuing your rightful claim.

- Denying claims without reason: Failing to provide a valid, fact-based explanation for a denial.

Not every disagreement is bad faith, but when an insurer’s actions are deceptive or show a clear disregard for their obligations, lawyers that sue insurance companies can help you fight back.

Common Reasons for Claim Denials and Disputes

Understanding legitimate denials helps you identify bad faith. A claim might be fairly denied for:

- Policy exclusions: The policy may specifically exclude the type of damage or event. For example, standard homeowner policies often exclude flood damage.

- Insufficient documentation: You must provide adequate evidence to support your claim, such as photos, medical records, or repair estimates.

- Disputed liability: In an auto accident, if there’s a genuine disagreement over who was at fault, the other driver’s insurer may deny your claim.

- Pre-existing conditions: A health or disability claim may be denied if the condition existed before you obtained coverage and is excluded by the policy.

- Lapsed policy: If your policy was not active when the incident occurred, the insurer has valid grounds for denial.

The line between a legitimate denial and bad faith can be blurry. An insurer might misinterpret policy language or make unreasonable demands for documentation. This is why having experienced lawyers that sue insurance companies is crucial to protect your rights as a policyholder.

Your First Steps: Building a Case Against Your Insurer

If you suspect your insurance company is acting unfairly, you must shift from a trusting customer to a careful investigator. Every interaction becomes potential evidence. While this can feel overwhelming, taking the right steps gives you power.

The Crucial Role of Documentation and Communication

Proper documentation is critical. Without it, even a clear case of bad faith becomes a hard-to-win “he said, she said” dispute.

- Keep all correspondence: Save every letter, email, and notice from your insurer. These documents tell the story of how your claim was handled.

- Log all phone calls: Note the date, time, representative’s name, and a summary of the discussion. This can reveal patterns of delay or misinformation.

- Communicate in writing: Use email whenever possible to create a paper trail. After a phone call, send a follow-up email confirming what was discussed.

- Avoid recorded statements: Insurers often use these to twist your words against you. Politely decline and offer to provide information in writing, unless your attorney advises otherwise.

- Preserve evidence: Take photos of property damage and keep all medical records and bills organized. As our guide on Documenting Evidence in Personal Injury Claims explains, this is the foundation of your case. Be aware of laws like Florida Spoliation of Evidence, which prevent the destruction of important evidence.

How to Effectively Interact with an Insurance Claims Adjuster

The adjuster works for the insurance company, not you. Their goal is to settle your claim for as little as possible.

- Be polite but firm: You have rights as a policyholder. State your case professionally and don’t let them walk over you.

- Provide facts only: Stick to what happened and what damages resulted. Avoid speculating about fault or offering opinions.

- Do not admit fault: Even saying “I’m sorry” can be misinterpreted as an admission of guilt. Fault is a complex legal determination.

- Do not sign waivers: Never sign a release or waiver without an attorney’s review. These documents can forfeit your right to future compensation. A request for an Examination Under Oath is a formal proceeding that requires legal representation.

- Refer them to your attorney: Once you hire lawyers that sue insurance companies, direct all communication to them. This protects you from saying something that could harm your case.

When your insurer isn’t treating you fairly, it’s time to level the playing field with professional legal help.

The Power of Legal Representation: How Lawyers That Sue Insurance Companies Can Help

Going against a major insurance company is daunting. They have vast resources and legal teams dedicated to protecting their profits. This is why experienced lawyers that sue insurance companies are essential—we level the playing field.

At Carey Leisure Carney, our Board-Certified attorneys represent the top 2% in Florida and have over 100 years of combined experience battling insurers. We know their tactics and how to beat them. When you work with us, you get direct access to your attorney and personalized attention. Having guided roughly 40,000 injury matters across Florida, we’ve seen every trick in the book.

Navigating Common Disputes: Types of Claims Lawyers That Sue Insurance Companies Handle

Our lawyers handle a wide variety of insurance disputes.

- Auto accident claims: We fight insurers who dispute fault, question medical treatment, or make lowball offers. We help clients with their Uninsured vs. Underinsured Motorist Coverage Explained to ensure they receive full compensation.

- Homeowner claims: For damage from hurricanes, fires, or other disasters, insurers may try to blame non-covered causes or lowball repair costs. Our guide on Property Homeowner and Renter Coverage Part 3: Insurance 101 explains many of these complex issues.

- Disability claims: When you can’t work, we challenge insurers who claim you’re “not disabled enough” or that your condition was pre-existing.

- Life insurance disputes: We contest denials based on alleged misrepresentations on applications or other policy exclusions.

Whatever your dispute, we have the expertise to fight for your rights.

Understanding Contingency Fees: Accessing Justice Without Upfront Costs for lawyers that sue insurance companies

One of the biggest advantages of working with us is our contingency fee arrangement: you don’t pay any legal fees unless we win your case.

We only get paid when you get paid. Our fee is a percentage of your settlement or award, which means we are fully invested in getting you the maximum compensation possible. Your success is our success.

It’s important to distinguish between legal fees and costs. Fees are for our time and expertise. Costs include court filing fees, expert witness fees, and deposition expenses. We advance these costs, and they are reimbursed from your settlement only if we win.

This system makes justice accessible to everyone, regardless of financial status. If you’re wondering When to hire lawyer? or are concerned about expenses, our article on How much does it cost to hire a personal injury attorney? provides more detail. Our contingency fee model means we believe in your case and are ready to invest our resources to win.

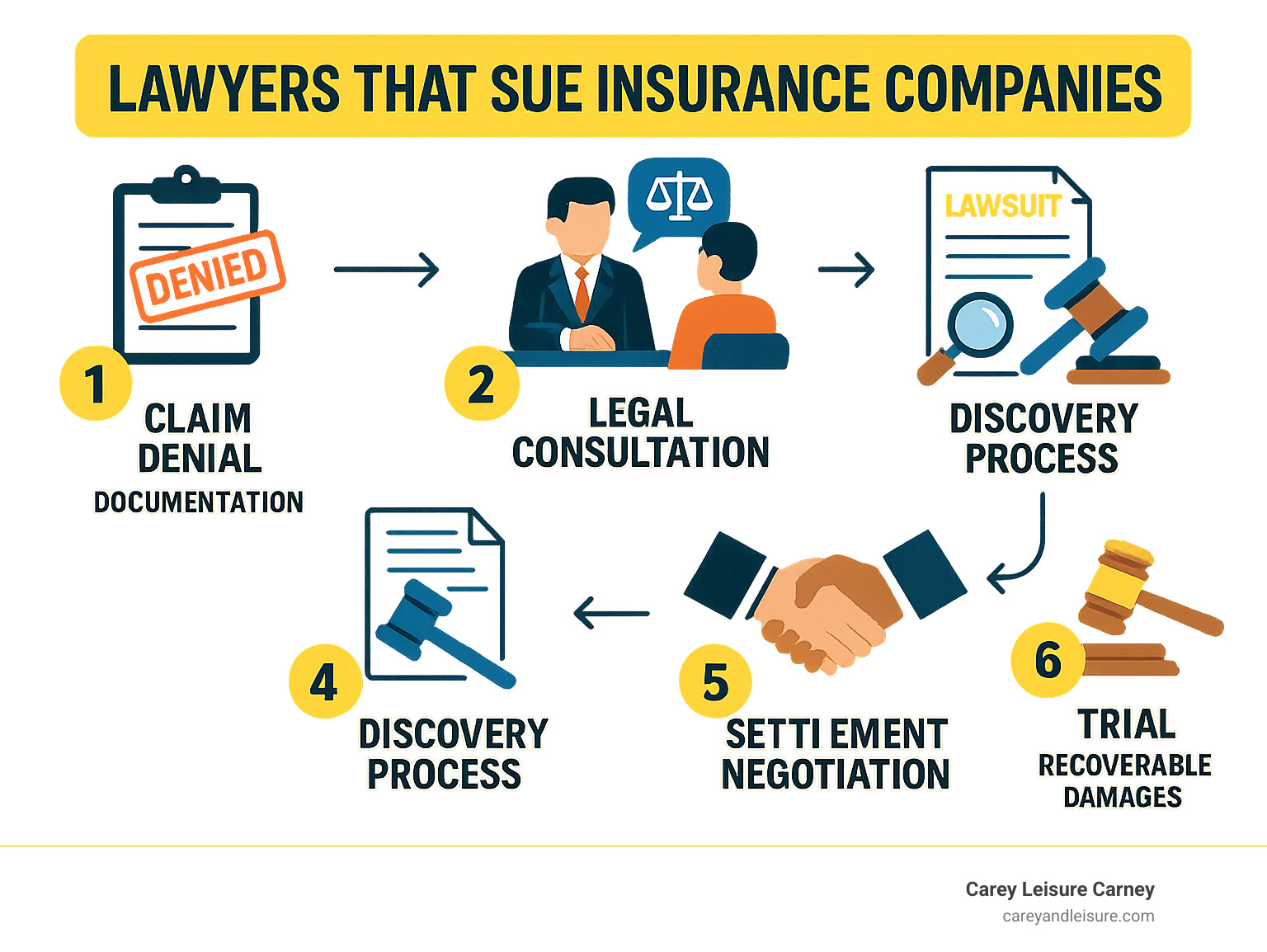

The Legal Battle: What to Expect in a Bad Faith Lawsuit

Deciding to sue your insurer can be intimidating, but understanding the process helps. Filing the lawsuit is just the start. The next phase is “findy,” where both sides exchange information and evidence. You may be asked to give a deposition—a formal interview under oath—but your legal team will prepare you thoroughly.

We often bring in expert witnesses to testify on industry standards or the value of your damages. Throughout this process, settlement negotiations continue, and many cases are resolved before trial. If a trial is necessary, we will present your case to a judge or jury to prove the insurer acted in bad faith. You can learn more about this on our The Litigation Process page.

Key Laws and Statutes of Limitations

In Florida, insurers have a legal “duty of good faith and fair dealing.” This means they must treat your claim fairly and honestly. When they fail, you can take action.

The statute of limitations is a critical deadline for filing a lawsuit. In Florida, the time limits differ for breach of contract and bad faith claims.

- Breach of contract claims focus on whether the insurer violated the specific terms of your policy. Damages are typically limited to the policy benefits you were owed.

- Bad faith claims are more complex. They require proving the insurer acted unreasonably without a valid reason, as defined under laws like Florida Statute 624.155. While the legal standard is higher, potential damages can be much greater.

Understanding these nuances is why experienced legal representation is so important. We can determine the best strategy for your situation.

Potential Damages You Can Recover

In a successful bad faith lawsuit, you can recover significantly more than your original claim amount. The law recognizes that an insurer’s misconduct causes harm beyond just unpaid benefits.

- Policy benefits: The money the insurer should have paid in the first place.

- Consequential damages: Losses resulting directly from the bad faith conduct, such as damage to your credit rating or foreclosure on your home.

- Emotional distress: Compensation for the stress, anxiety, and frustration caused by the insurer’s actions. Our page on Compensation for Pain and Suffering in Florida: What You Need to Know explains this further.

- Attorney’s fees and costs: The insurer may be required to pay for your legal representation.

- Punitive damages: These are intended to punish the insurer for egregious conduct and deter future misconduct. They can be substantial, sometimes reaching millions.

The amount of damages depends on the severity of the insurer’s misconduct and its impact on your life. Our experience with Personal Injury Settlement Examples shows a range of outcomes, but every case is unique.

Frequently Asked Questions about Suing Insurance Companies

Taking on an insurance company can feel overwhelming, and you likely have many questions. Here are answers to the concerns we hear most often.

How long does it take to sue an insurance company?

There’s no simple answer, as every case is unique. The timeline can range from a few months to several years, depending on several factors:

- Case complexity: A straightforward case with clear evidence of bad faith may resolve faster than one with disputed facts or complex medical issues.

- Insurer’s cooperation: Some insurers negotiate quickly once they see you have serious legal representation. Others will fight every step, hoping you’ll give up.

- Settlement vs. trial: Most cases settle out of court, which is generally faster. If an insurer refuses to make a fair offer, going to trial is necessary but extends the timeline.

Our priority is to work efficiently without rushing into a settlement that is less than what you deserve. Your full financial recovery is our goal.

Can I sue my own insurance company after a car accident?

Yes, and it’s quite common. In Florida’s “no-fault” system, your own Personal Injury Protection (PIP) coverage is supposed to pay for your initial medical bills and lost wages. However, your insurer might unfairly deny your PIP benefits, underpay your property damage claim, or dispute your uninsured motorist claim if you’re hit by a driver with no insurance. We discuss this situation in our article about Car Accident No Insurance Not At Fault Florida.

These are called “first-party claims,” and your insurer still has a duty of good faith. You paid your premiums trusting them to protect you; it’s fair to hold them accountable if they fail to do so.

What are my chances of winning a lawsuit against an insurance company?

While no outcome can be guaranteed, several factors significantly increase your chances of success:

- Strong evidence: Detailed documentation is your most powerful tool. Emails, call logs, and denial letters provide concrete proof of bad faith.

- Quality legal representation: Insurers have experienced lawyers. You need lawyers that sue insurance companies who know their tactics. Our Board-Certified attorneys have decades of experience fighting and winning these battles.

- Proof of bad faith: You must prove the insurer acted unreasonably or deceptively without a valid reason. This requires a deep understanding of insurance law, which is where our expertise is crucial.

Insurance companies often deny claims, betting that you won’t fight back. With an experienced legal team, you can show them they made a bad bet and level the playing field.

Conclusion: Protecting Your Rights and Holding Insurers Accountable

After an accident or property damage, you shouldn’t have to fight your own insurance company. Yet, many policyholders find the “safety net” they paid for is full of holes. The truth is, you have rights as a policyholder, and you can hold insurers accountable when they act in bad faith.

Documentation is your best friend. Every email, call log, and letter provides concrete proof of an insurer’s conduct. This evidence is key to building a strong case.

At Carey Leisure Carney, our Board-Certified attorneys represent the top 2% of lawyers in Florida and bring over 100 years of combined experience to every case. We know the games insurance companies play and how to win.

What sets us apart is our commitment to direct attorney access and personalized service. We serve clients throughout Florida, including Clearwater, St. Petersburg, Spring Hill, and Wesley Chapel. Whether you’re facing a denied auto claim, hurricane damage, or another insurance dispute, we’re here to level the playing field.

Seeking expert legal counsel is not admitting defeat—it’s taking control. Insurers count on you being too overwhelmed to fight back. Don’t let them win by default. The road to accountability starts with having the right team in your corner.

Find out more about how we handle Bad Faith insurance claims and let us put our experience to work for you. When insurance companies don’t play fair, you need a team that will fight for you.