PIP coverage limits: Maximize Your 2025 Protection

Why Understanding Your PIP Coverage Limits Matters

PIP coverage limits determine the maximum amount your insurance will pay for your medical bills and lost wages after a car accident. In Florida, these limits are typically $10,000, but can drop to just $2,500 if your injury isn’t deemed a medical emergency. Understanding these limits is crucial, as it can be the difference between having your expenses covered and facing significant out-of-pocket costs.

Quick Answer for PIP Coverage Limits:

- Florida minimum: $10,000 per person (reduced to $2,500 without an Emergency Medical Condition)

- Coverage includes: 80% of medical bills, 60% of lost wages, essential services

- Time limit: Must seek treatment within 14 days of the accident

- No-fault system: Your own insurance pays regardless of who caused the crash

Florida’s no-fault system requires drivers to carry Personal Injury Protection, but many people don’t realize their coverage might not be enough until it’s too late. The complexity goes beyond just dollar amounts. Florida’s unique Emergency Medical Condition requirement can cut your available benefits by 75% if not properly documented. Your PIP coverage acts as your financial safety net, paying for immediate medical care and lost wages, but if your limits are too low, you could find yourself struggling with unpaid bills.

What Personal Injury Protection (PIP) Actually Covers

When you’re in a car accident in Florida, Personal Injury Protection is your immediate lifeline. It operates on a no-fault principle, meaning your own insurance helps you right away, regardless of who caused the crash. This financial safety net provides for immediate medical care and support when you need it most. For a comprehensive breakdown, see our guide: What is Covered Under Personal Injury Protection?.

Medical and Rehabilitation Expenses

PIP takes the financial stress out of getting medical care. In Florida, it typically covers 80% of reasonable and necessary medical expenses, including:

- Hospital bills and emergency room visits

- Doctor visits and specialist consultations

- Surgical services and ambulance fees

- Physical therapy and necessary prescriptions

- Dental care for accident-related injuries

This coverage allows you to focus on healing instead of worrying about payment.

Lost Wages and Essential Services

An accident can impact your ability to work and manage daily life. In Florida, PIP covers 60% of your lost wages if injuries keep you from working. It also covers “essential services” like childcare costs or household help. In tragic cases, PIP provides funeral expenses and death benefits. Your PIP coverage limits determine the maximum amount you can receive.

What PIP Doesn’t Cover

It’s important to know PIP’s limitations:

- Other driver’s injuries: Covered by your Bodily Injury Liability coverage

- Vehicle damage: Handled by property damage or collision coverage

- Pain and suffering: PIP covers economic losses only, not emotional distress

For protection against liability claims, you need separate coverage. Learn more here: Liability Insurance: How to Stay Protected.

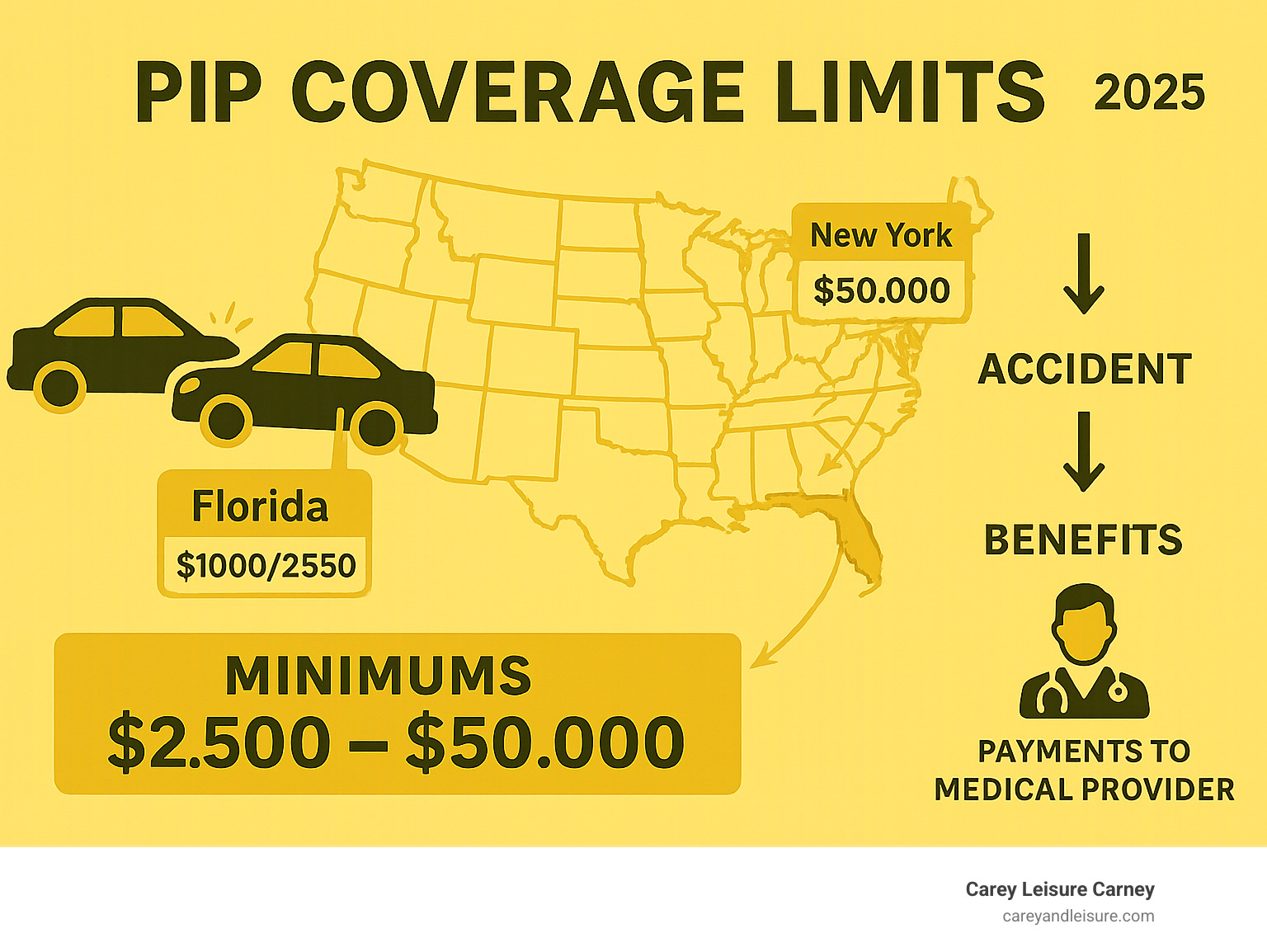

Understanding State-Mandated PIP Coverage Limits

When it comes to PIP coverage limits, each state has its own unique rules. The core idea is to provide immediate financial protection after an accident, regardless of fault, but the required coverage amounts vary widely. States set minimum requirements, but you can usually purchase higher limits for more protection.

Florida’s PIP Requirements and Limits

Florida requires all drivers to carry PIP coverage, but there’s a critical catch. While the standard policy has a $10,000 minimum limit, you only get access to the full amount if a doctor certifies you have an Emergency Medical Condition (EMC). If your injuries don’t qualify as an EMC, your benefits are capped at just $2,500.

Timing is also crucial. Florida’s 14-day rule requires you to get medical attention within two weeks of your accident, or you could lose your PIP benefits entirely. We’ve seen many clients who delayed seeing a doctor and unfortunately forfeited their coverage. For complete details on Florida’s requirements, review the official guidelines at Florida Insurance Requirements. To understand the urgency of this timeline, read our article on how much time you have to see a doctor after a car accident.

A Look at PIP Coverage Limits in Other States

Florida’s system is complex, but other states also have unique rules. The required coverage amounts vary dramatically. For example, New York mandates a generous $50,000 per person limit, while Texas requires only $2,500. Michigan has a unique system with options ranging from opting out entirely to unlimited lifetime benefits. These differences highlight why understanding your specific state’s requirements is so important.

How Your PIP Coverage Limits Are Applied After an Accident

In Florida’s no-fault system, your PIP acts as primary coverage, paying first regardless of who caused the crash. After you submit claims, your insurer pays them from your PIP policy until the limit is reached. If your policy has a deductible, you must pay that first.

Once you exhaust your benefits, your health insurance typically becomes the secondary payer. This coordination can be complicated, especially when medical bills are high. For guidance on what to do after a crash, see our guide: What to do after a car accident in Florida. A single serious injury can easily use up the $10,000 limit, leaving you to steer other insurance policies or claims against the at-fault driver.

PIP vs. Other Auto Insurance Coverages

Your auto insurance policy is a package of different coverages, each with a specific role. Understanding how Personal Injury Protection (PIP) works with other coverages like Bodily Injury Liability (BI), Medical Payments (MedPay), and Uninsured/Underinsured Motorist (UM) coverage is key to ensuring you’re fully protected. In Florida’s no-fault system, PIP is the foundation for your own injuries. Learn more in our guide to No-Fault Insurance Florida.

Key Differences Between PIP and MedPay

Many people confuse PIP and Medical Payments (MedPay) coverage. While both cover medical bills regardless of fault, they are not interchangeable. The main difference is the scope of coverage. PIP is broader, covering not only medical expenses but also a percentage of lost wages and costs for essential services like childcare. MedPay typically only covers medical and funeral expenses. Additionally, PIP is required in no-fault states like Florida, while MedPay is usually an optional add-on.

How PIP Differs From Bodily Injury (BI) Liability

It’s crucial to distinguish between PIP and Bodily Injury (BI) liability, as they protect different people.

- PIP protects you and your passengers. It pays for your medical bills and lost wages, regardless of who caused the accident.

- BI Liability protects others. It pays for injuries and damages you cause to other people if you are at fault for an accident.

In short, PIP is your first-party coverage for your own injuries, while BI is third-party coverage that protects you from lawsuits when you injure someone else.

TABLE: Comparing PIP, MedPay, and Bodily Injury Liability

| Coverage Type | Who It Covers | What It Pays For | Fault Requirement |

|---|---|---|---|

| PIP (Personal Injury Protection) | You, your passengers, sometimes pedestrians | Medical bills (80% in FL), lost wages (60% in FL), essential services, funeral expenses | No-fault – pays regardless of who caused accident |

| MedPay (Medical Payments) | You and your passengers | Medical expenses, funeral costs | No-fault – pays regardless of who caused accident |

| Bodily Injury Liability | Other drivers, passengers, pedestrians you injure | Medical bills, lost wages, pain and suffering, other damages to injured parties | Fault-based – only pays when you cause the accident |

Understanding these differences helps you see why you need multiple types of coverage. PIP coverage limits protect you and your family, while other coverages protect you from financial responsibility to others. Together, they create a comprehensive shield against the financial impact of car accidents.

What Personal Injury Protection (PIP) Actually Covers

Personal Injury Protection (PIP) is critical in “no-fault” states like Florida. Its core purpose is providing immediate financial assistance for injuries sustained in a car accident, regardless of who caused the crash. Your own insurance policy covers your medical expenses and related costs without waiting for fault determination. For a comprehensive overview, read: What is Covered Under Personal Injury Protection?.

Medical and Rehabilitation Expenses

PIP coverage in Florida pays for 80% of reasonable and necessary medical bills, including:

- Hospital bills and emergency room visits

- Doctor visits and specialist consultations

- Surgical services and ambulance fees

- Physical therapy and prescriptions

- Dental care for accident injuries

Lost Wages and Essential Services

Beyond medical bills, PIP covers economic losses from your injuries. In Florida, PIP typically covers 60% of lost income if injuries prevent you from working. It also helps with “essential services” you can no longer perform:

- Childcare costs

- Household help

- Funeral expenses (in fatal cases)

- Death benefits for surviving family

Other states have varying sub-limits. For example, Minnesota includes $500/week for disability income, New York provides 80% of lost income up to $2,000/month, and Utah offers $250/week for lost income. These varied benefits highlight the importance of understanding your specific PIP coverage limits.

What PIP Doesn’t Cover

PIP is specifically for your personal injuries and related economic losses. It does not cover:

- Other driver’s injuries (covered by Bodily Injury Liability)

- Vehicle damage (requires Collision or Comprehensive coverage)

- Pain and suffering (pursued through liability claims)

To ensure full protection, you need other coverage types. Learn more: Liability Insurance: How to Stay Protected.

Understanding State-Mandated PIP Coverage Limits

The world of PIP coverage limits varies significantly by state. While the core concept remains consistent—no-fault injury coverage—the specifics of required coverage amounts differ widely. States set minimum “per-person” limits (maximum paid for one individual’s injuries) and sometimes “per-accident” limits (total for all injured parties). Many insurers offer optional add-ons for higher limits.

Florida’s PIP Requirements and Limits

Florida requires all drivers to carry PIP coverage with critical nuances. The minimum policy is $10,000 per person, but full access requires an Emergency Medical Condition (EMC) diagnosis. Without EMC, benefits cap at just $2,500.

Florida’s 14-day rule is crucial—you must seek medical attention within two weeks of your accident or forfeit PIP benefits entirely. For complete details, visit: Florida Insurance Requirements. To understand this timeline’s urgency, read: How much time do I have to see doctor after car accident?.

A Look at PIP Coverage Limits in Other States

Other states have varying requirements:

- New York: $50,000 per person

- Michigan: Options from $0 to unlimited coverage

- Massachusetts: $8,000 per person

- Minnesota: $40,000 per person

- Oregon: $15,000 minimum

- New Jersey: $15,000 to $250,000 for severe injuries

- Texas: $2,500 per person

- Pennsylvania: $5,000 minimum

- Hawaii: $10,000 per person

The range is vast, underscoring the importance of understanding your coverage and considering higher limits where available.

How Your PIP Coverage Limits Are Applied After an Accident

In Florida’s no-fault system, PIP acts as primary coverage, paying first regardless of fault. The process:

- Your insurer pays claims from your PIP policy until limits are reached

- If your policy has a deductible, you pay that first

- Once benefits are exhausted, health insurance becomes secondary payer

- You may then pursue claims against the at-fault driver

For guidance after a crash, see: What to do after a car accident Florida.

PIP vs. Other Auto Insurance Coverages

Understanding your auto insurance policy can feel complex. Beyond Personal Injury Protection (PIP), several other coverages work together to protect you after a crash.

Common policy components include:

- Bodily Injury Liability (BI): Covers injuries you cause to others.

- Property Damage Liability (PD): Covers damage you cause to another’s property.

- Medical Payments (MedPay): Similar to PIP, but usually narrower.

- Collision: Covers damage to your own vehicle from a collision.

- Comprehensive: Covers non-collision damage to your vehicle (theft, weather, vandalism).

- Uninsured/Underinsured Motorist (UM/UIM): Protects you if the at-fault driver has no or insufficient insurance.

In Florida, our no-fault insurance system makes PIP foundational. For a deeper dive, read: No-Fault Insurance Florida.

Key Differences Between PIP and MedPay

- Scope: Both pay medical expenses regardless of fault. PIP is broader, often covering a portion of lost wages and essential services; MedPay typically does not.

- Deductibles: PIP may have a deductible; MedPay usually does not.

- Availability: PIP is required in no-fault states like Florida; MedPay is generally optional.

How PIP Differs From Bodily Injury (BI) Liability

- Who is covered:

- PIP: You and your passengers (and sometimes pedestrians/cyclists) for medical costs and certain economic losses, regardless of fault.

- BI Liability: Other people you injure when you are at fault; helps protect you from lawsuits.

- Fault:

- PIP: No-fault—pays regardless of who caused the crash.

- BI Liability: Fault-based—applies when you are legally liable.

- Legal status:

- PIP: Mandatory in Florida.

- BI Liability: Required in most states and essential for financial responsibility.

TABLE: Comparing PIP, MedPay, and Bodily Injury Liability

| Coverage Type | Who It Covers | What It Pays For | Fault Requirement |

|---|---|---|---|

| PIP (Personal Injury Protection) | You and your passengers (sometimes pedestrians) | Medical bills (in FL typically 80%), a portion of lost wages (in FL 60%), essential services, funeral expenses (up to policy limits) | No-fault |

| MedPay (Medical Payments) | You and your passengers | Medical and funeral expenses (no wage loss/essential services) | No-fault |

| Bodily Injury Liability | Others you injure | Their medical bills, lost wages, pain and suffering, other damages (up to your limits) | Fault-based |

Frequently Asked Questions about PIP Coverage

When you’re dealing with car accidents and insurance claims, it’s natural to have questions. We’ve been helping clients steer PIP coverage limits for years, and these are the questions that come up most often in our conversations.

Can I use PIP if the accident was my fault?

Absolutely, yes! This might surprise you, but it’s one of the key features of Florida’s no-fault insurance system. Your PIP coverage limits apply regardless of who caused the accident—even if you were at fault. The system is designed so you can get immediate medical care without waiting for a lengthy investigation to determine who was responsible.

What happens if my medical bills exceed my PIP coverage limits?

This is a common concern, as Florida’s minimum PIP coverage limits can be exhausted quickly. When your PIP runs out, your health insurance typically becomes the secondary payer for medical expenses, though you may be responsible for deductibles and copays. If another driver was at fault, you may be able to file a claim against their liability insurance for expenses beyond your PIP limits, including compensation for pain and suffering.

Can I choose a higher PIP limit than the state minimum?

You can, and it’s often a wise decision. While Florida law sets a minimum, most insurers offer the option to purchase higher PIP coverage limits. The additional premium is often modest compared to the significant extra protection it provides. Considering the high cost of medical care, increasing your PIP limits can be a smart financial move that provides greater peace of mind. For more help, resources like How Much Personal Injury Protection Insurance Do I Need? can offer additional perspective.

Conclusion: Get Expert Guidance on Your Florida PIP Claim

Understanding PIP coverage limits is the first step in protecting yourself after a car accident. As we’ve covered, Florida’s no-fault system has unique rules, like the 14-day rule and the Emergency Medical Condition (EMC) requirement, that can make or break your claim. A $10,000 policy can quickly shrink to $2,500, or even zero, if you don’t steer the process correctly.

Don’t risk facing thousands in unpaid medical bills because of a technicality. Insurance companies have teams of adjusters and lawyers working to minimize their payouts. You need an expert on your side.

At Carey Leisure Carney, we’ve spent decades helping clients in Clearwater, Largo, New Port Richey, St. Petersburg, and across Florida secure the full benefits they deserve. Our Board-Certified attorneys represent the top 2% in Florida and provide direct, personal service. We stay on top of every change in the law, including the latest New PIP Florida Law Changes, to give you the best possible advantage.

If you’re dealing with a denied PIP claim or have questions about your coverage, contact us today. Let our experience work for you.